Money market mutual fund schemes in India comes under debt instruments. It is also loosely known as “liquid funds”. However, technically liquid funds are different from money market funds. Liquid funds invest in debt and money market securities with a maturity of up to 91 days only. However, in money market funds investments are made in money market instruments having maturity up to one year.

Here, in the present blog, I am going to discuss exclusively on the methods that will help in picking right kind of money market mutual fund schemes for your portfolio. I will keep discussion keeping in view the needs of a typical retail investor in India. Besides, an exclusive list of money market mutual fund schemes is there that will help you choose easily among the alternatives. Along with it, a brief introduction to mutual funds scheme in India with some emphasis on money market-based funds is also there.

There are some specific facilities with such debt mutual funds that invest solely in money market instruments. You will find a discussion on it as well. I am confident that after reading this blog till the end you will not only be convinced for MMMFs but also initiate a plan to buy some for your long-term portfolio.

Why mutual funds selection is a complex process in India?

There are over 40 asset management company operating in Inda. They manage over 11 thousands schemes which are in itself very huge. Being a retail investor, it is not an easy task to scrutinize this quantum of schemes. You need to pick a handful of the scheme for your personal portfolio. Schemes that suites all of you time-bound requirements especially of future. Your needs may arise in some near future on you might have some plan to fulfil in long duration. So there exists complexity.

Further, the selection of a scheme that might result in an optimal selection for you is also tedious work. For it, it is essential not only to understand the short term money need of such retail investors, which is diverse in nature but also need to have a deep understanding of mutual funds structure and their working.

Mounting to the complexity is that every retail investor need for money varies. Also, there are inconsistencies even for any retailer when the time dimension is added. Moreover, the very heterogeneous nature of the schemes of mutual funds only added confusion rather making short-term investment life simple for such retailers.

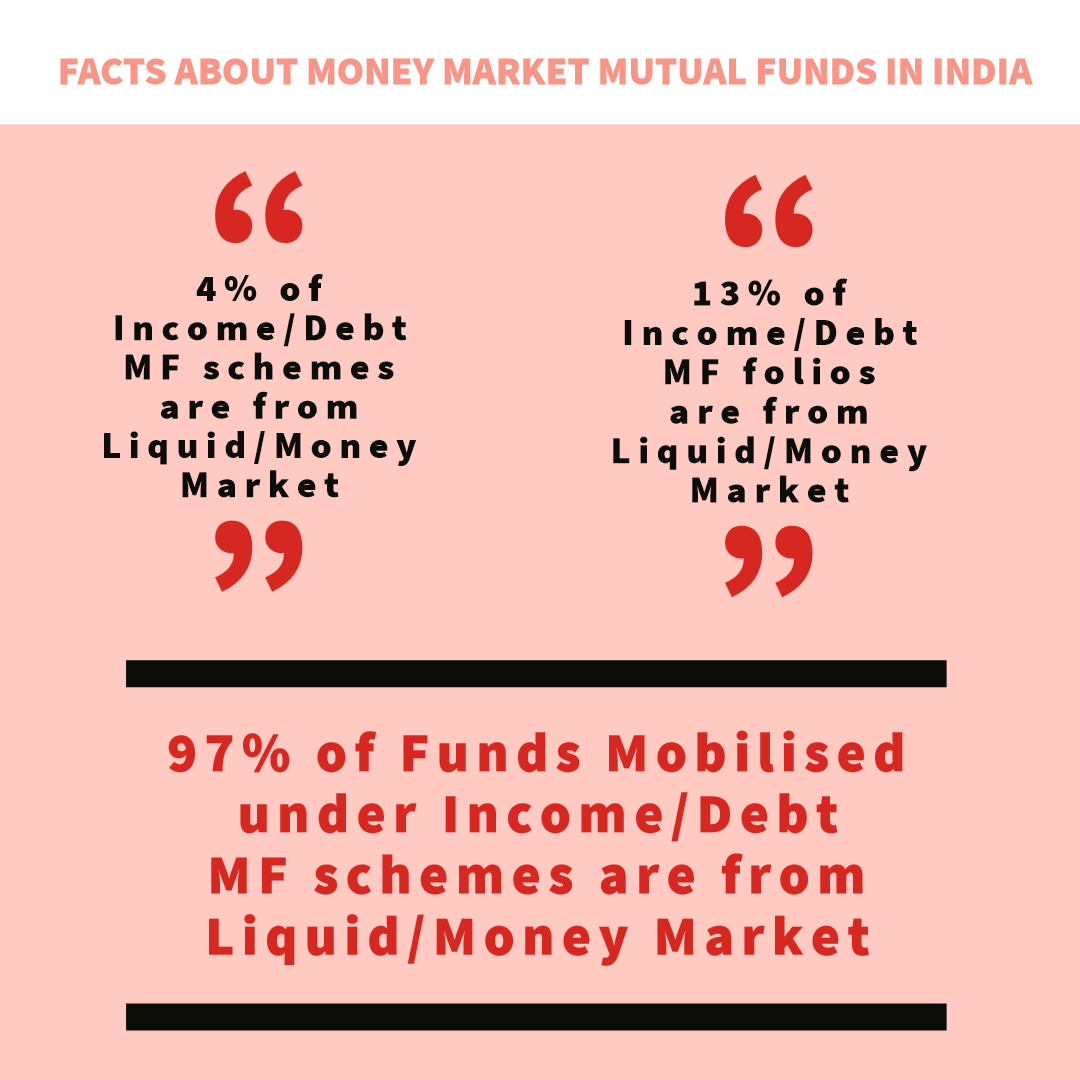

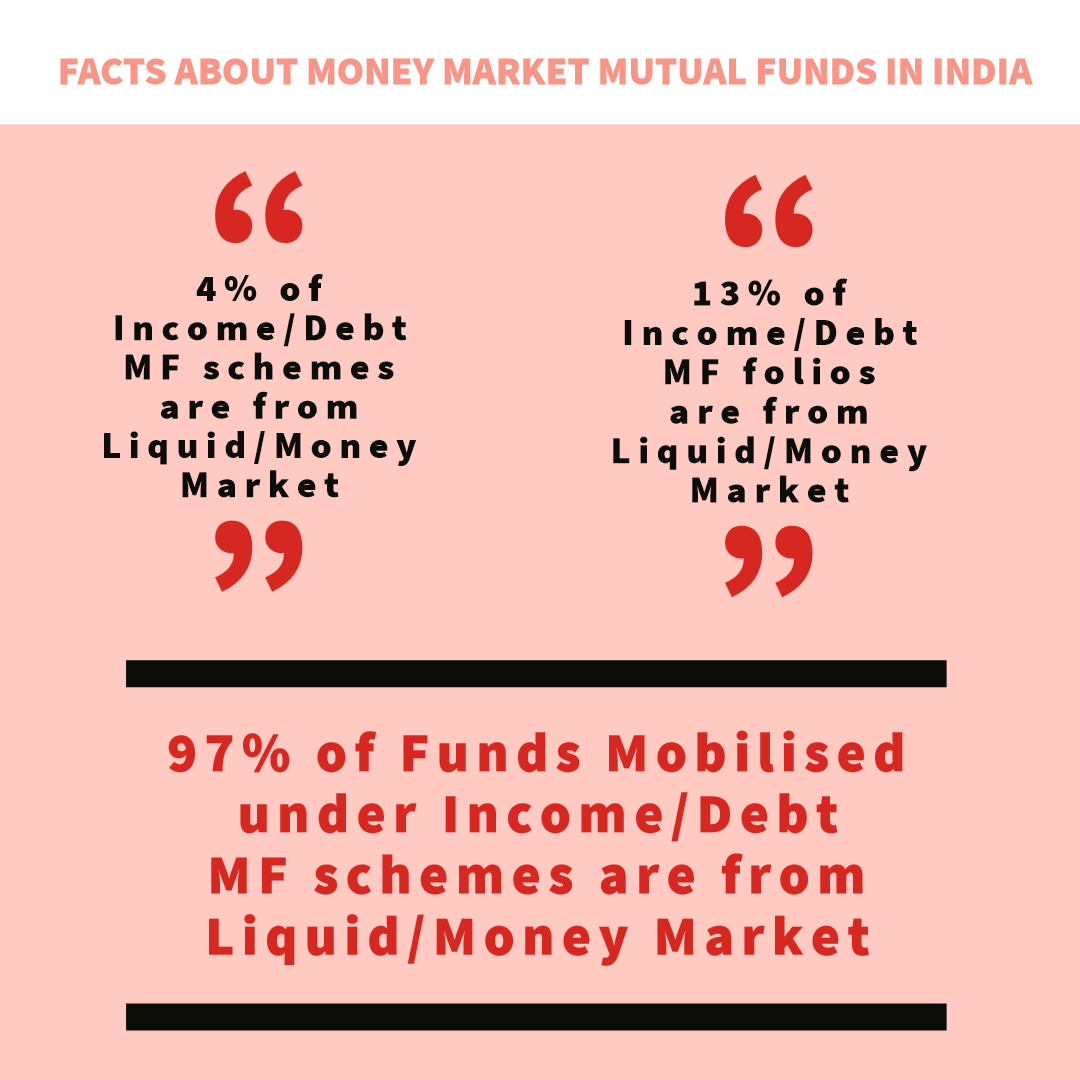

Data for “Facts about money market in India” is collected from RBI statistics – October 2018

Demystifying the structure of Indian money market mutual funds?

In India, money market mutual funds are part of liquid funds. Liquid funds, in turn, are part of income/debt oriented mutual funds schemes. Other schemes that are part of debt segments are gilt, assured return and without assured return debt, and infrastructure development. All of the schemes that come under money market/liquid funds are open-ended schemes.

In October 2017, SEBI came up with a notification on categorization and recategorization of mutual fund schemes. It suggests that all mutual funds schemes in India should be in any one of the following main categories –

- Equity schemes

- Debt schemes

- Hybrid schemes

- Solution oriented schemes

- Other schemes

Each of these main categories has several sub-categories each. Money market mutual funds is a sub-category that comes under the main category of debt schemes. Next to this categorization of mutual funds, is the classification on the basis of sellers of the mutual funds. There are two classifications on this basis.

“Open-End” mutual funds are investments that issue and redeems units at any time. As an investor, you purchase units directly from the funds and not from the existing unit-holders. The other kind is “Closed-End” funds. Here fund issues a fixed number of units and you cannot redeem it. However, you can buy such funds from existing unit-holders through stock exchanges.

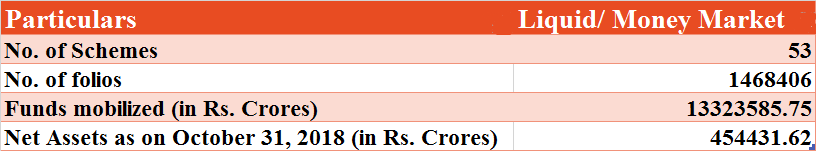

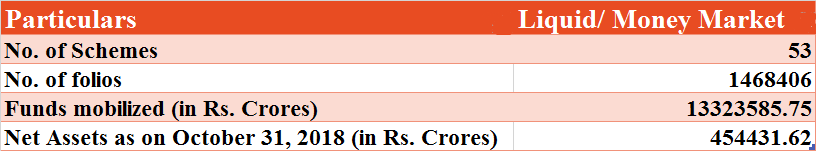

Money market mutual funds in India as per RBI October 2018 statistics

Please note that, as per RBI, money market mutual funds come under the SEBI regulations. However, any bank needs to get RBI clearance before launching any money market mutual funds schemes. Thus, money market mutual funds need to follow both RBI’s and SEBI instructions. Now before proceeding in the intricacies of the selection methods of money market mutual funds, I am briefing some important considerations specific to MMMFs.

What makes MMMF schemes special?

Money market mutual fund schemes have certain added advantages over other schemes in debt segment. Understanding these characteristics will help you decide on modus operandi with such investments. I am explaining them in details in the below paragraphs.

1. Avail cheque writing facility with money market mutual funds

An important characteristic feature of money market mutual funds is that it offers cheque writing facility to retail investors. As per RBI’s “Master circular – Para Banking Activities“, banks operating in India have permission to tie up with mutual funds that have schemes with 80% investment in gilt and income schemes or operates full fledges money market schemes. Such banks with tie-ups can offer cheque writing facilities to the investors. However, the following safeguards, such banks need to follow –

- The tie-up arrangements should be with sponsorer bank in case of MMMF schemes. In other cases, it should be with designated banks. You will find these pieces of information on the offer documents of the schemes.

- The tie-ups actually is a commercial agreement between mutual funds and banks. It is nothing to with servicing of the units of money market mutual funds in question.

- There is no deposit facility with this kind of cheque. As an investor, you can only make the withdrawal with it. Also, you cannot make a third party payment with it. Only you can draw the cheques favouring your account.

- Withdrawals are actually redemptions of your holdings in the money market mutual funds. It will extend only to the maximum limit of the units that you hold.

2. Systematic investment plan for MMMFs

Sip is a great way to achieve your financial goals with ease. Almost all money market mutual funds allow for SIP investment. If you are looking for how SIP will help you achieve your financial goals, you must read this blog article specially written to address this.

Selecting money market mutual fund schemes for your portfolio

Coming to the point. There are 14 AMC that runs schemes that are exclusive money market mutual fund schemes. As per the latest SEBI regulation, only two categories of schemes is there for retail investors. They are the direct plan and regular plan. However, please note that all other types of plan that were in circulation prior to 2017 will continue till investors hold them. But no AMC can issue such plans now. The list of such money market mutual fund houses are –

1. ABSL Money Manager Fund

The Aditya Birla sun life money manager fund have schemes for retail investors. Schemes are capable to generate regular income with investment in money market instruments. If you are looking for reasonable returns with ample liquidity, this scheme is for you. The fund manager of this fund invests your money in a mix of fixed and floating rate money market instruments with a maturity of up to one year. You can initiate investment in this scheme with as low as INR 1000. The fund manager was able to get you a consistent yearly return of over 7% since the last 3 years.

2. L&T Money Market Fund

In L&T money market fund schemes, you can initiate your investment with INR 1000 only. Being a retail investor you need to keep in mind that there is minimum redemption amount as well. INR 500 or 50 units you need to redeem in one go. Fund managers of L&T money market schemes generate regular income for short to the mid-term basis for you. Over and above 7% of yearly return was there in this scheme in the last few years.

3. DSP Savings Fund

This income generation scheme by DSP mutual fund carries moderate risks of investments. DSP savings fund manages to fetch a little below 7% yearly return since the last couple of years. As a retail investor, you can invest as low as from INR 500 in this scheme. The fund managers of the DSP savings scheme invest primarily in money market instruments with up to one year of maturity on regular basis.

4. Franklin India Savings Fund

This moderately low-risk investment scheme by Franklin mutual fund is suitable for people looking for high liquidity. Franklin India savings fund invests in money market instrument with a maturity of a very shorter end. With investment in such shorter duration instruments, the fund managers successfully manage the interest rate risks. If you are exclusively looking for regular income with duration of investment as low as one month, this scheme is for you. This scheme manages to generate below 8 % annual return since a couple of years.

5. HDFC Money Market Fund

Money market fund by HDFC Ltd. is a good performing in this category. It is generating around 7% annual return since last 3 years or so. If you have a surplus for three to six months and looking for capital appreciation, this scheme may suit you. You can start investing in HDFC money market fund with a minimum of INR 5000. The fund managers of this scheme use a combination of the instrument for the portfolio. Instruments include commercial papers, certificate of deposits, commercial bills, treasury bills, government securities having an unexpired maturity of less than one year, call money and etc.

6. ICICI Pru Money Market Fund

The average performing ICICI Pru money market fund carries low risk. The fund manager ensures for suitable returns with investment in a mix of money market and other debt instruments. Not only the risk is low but also your capital deployed in the fund is kept safe. You can initiate investment in this money market mutual funds with as low as INR 500 only. The fund managers manage to get ver and above 7% annual returns since last 3 years or so. ICICI Pru money market fund promises for a high level of liquidity as well.

7. IDFC Money Manager Fund

This is a below average performing fund. However, the good part is that you can invest wit as low as INR 100 in the scheme. The fund managers manage to generate a little above 6% yearly stable return since last 3 years. IDFC money manager fund invests in good quality fixed, floating and swapped for debt and money market instruments. If you are looking for short-term optimal return with relative stability and high liquidity, this fund is for you.

8. Invesco India Money Market

Invesco India money market fund is a very good performing MMMF scheme. Fund managers of this money market fund managers to get over 7 % annual return since last 3 consecutive years. They invest in instruments to generate superior-risk adjusted returns. Minimum investment requirement is INR 5000. The risks in Invesco India money market is moderately low. It is suitable for an investor who is seeking good income in a very short term.

9. JM Money Market Fund

The schemes by JM Money market fund claim to generate stable long-term returns. The fund managers keep low-risk strategies for capital appreciation while keeping capital safe. The JM Money market fund return around 7% annually so far in the last 3 continuous years. This money market mutual fund schemes adopt a scientific approach to investments. You can buy with as low as INR 5000 for the first time and additional purchases with INR 1000 and above. Also, there is no minimum redemption requirement.

10. Kotak Money Market Scheme

The average performing Kotak money market scheme carries short maturity and low volatility. As a retail investor, you can initiate with an initial investment of INR 5000 under, growth, weekly & monthly dividend option. However, under the daily dividend reinvestment option, you need a minimum investment of INR 1,00,000. You can also do additional investment in this scheme with INR 1000 and in multiples of INR 1. The objective of Kotak money market schemes is to reduce the interest rate risk in the fixed rate instruments investment. This minimization of risk the fund managers achieves by investing in floating rate securities, money market instruments and appropriate derivatives.

11. Reliance Money Market Fund

The Reliance money market fund invests exclusively 100% in money market instruments. The latest investments constitute 60% in commercial paper, 38% in certificate od deposits and the remaining 2% in cash and other receivables. The fund managers of Reliance money market fund keep the portfolio duration in between 80-120 days. The money market mutual fund schemes carry moderately low risks and maintain liquidity. The objective is to generate consistent and optimal returns over a period of time. For daily dividend option you need a minimum investment of INR 1,00,000 and in multiples of INR 1 thereafter. While for all other options you need INR 5000 as a minimum investment and in multiples of INR 1 thereafter.

12. SBI Savings Fund

The SBI savings fund schemes carry moderately low risk. This money market mutual fund schemes assures to generate stable returns through capturing term and credit spread. You can initiate investment in SBI savings fund with as low as INR 500 and in multiples of INR 1 thereafter. The fund managers were able to generate around 7% annual return so far in last 3 consecutive years.

13. Tata Money Market Fund

This is a week performing money market mutual fund schemes. The fund managers were able to get below 5% annual returns since last 3 years. If you want to efficiently utilize your idle cash and want low-risk investment, Tata money market fund is for you. The fund hopes to generate a reasonable return with high liquidity. You can purchase with minimum INR 5000, additional purchase with INR 1000 and in multiples of INR 1 thereafter. Keep in mind that a minimum of INR 1000 or 1 unit is mandatory during redemption. Further, if you redeem within 6 months of investment, you will need to pay an additional 2% of NAV along with other charges. There is daily, weekly, monthly and quarterly SIP option as well with this scheme.

14. UTI Money Market Fund

With UTI money market fund, the probability of your capital erosion is very low. Also, interest rate risk is at a minimum due to low duration investment. The fund managers were able to get below 7% annual return so far in last 3 years. You can initiate investment in schemes of UTI money market fund with INR 10,000 only.

Money market mutual fund schemes investment breakup

The following table summarizes the asset allocation my all 14 money market mutual fund schemes in India. This will give you a sense that where all your money is put by the fund’s managers so as to generate returns with the safety of your capital.

Asset allocation by Money market mutual fund schemes in India

|

| S.No |

Money market Mutual Fund Schemes |

Asset allocation (in percentage) |

| Debt |

Money Market |

Cash/Call |

Net Receivable/Payable |

Unlisted Instruments |

Mutual Funds |

| 1 |

ABSL Money Manager Fund |

0.42 |

98.67 |

0.94 |

-0.3 |

0 |

0 |

| 2 |

L&T Money Market Fund |

0 |

101.19 |

0 |

-3.22 |

2.03 |

0 |

| 3 |

DSP Savings Fund |

0 |

99.41 |

11.82 |

11.23 |

0 |

0 |

| 4 |

Franklin India Savings Fund |

0 |

98.74 |

1.26 |

0 |

0 |

0 |

| 5 |

HDFC Money Market Fund |

0 |

89.08 |

10.92 |

0 |

0 |

0 |

| 6 |

ICICI Pru Money Market Fund |

0 |

92.42 |

7.59 |

0 |

0 |

0 |

| 7 |

IDFC Money Manager Fund |

41.53 |

54.96 |

3.51 |

0 |

0 |

0 |

| 8 |

Invesco India Money Market |

0 |

84.49 |

6.32 |

0 |

0 |

9.16 |

| 9 |

JM Money Market Fund |

0 |

92.3 |

7.76 |

-0.07 |

0 |

0 |

| 10 |

Kotak Money Market Scheme |

0 |

93.67 |

6.33 |

0 |

0 |

0 |

| 11 |

Reliance Money Market Fund |

0 |

100.33 |

-0.33 |

0 |

0 |

0 |

| 12 |

SBI Savings Fund |

6.89 |

90.44 |

1.27 |

1.4 |

0 |

0 |

| 13 |

Tata Money Market Fund |

0 |

92.34 |

7.66 |

0 |

0 |

0 |

| 14 |

UTI Money Market Fund |

3.97 |

81.62 |

6.5 |

0 |

0 |

7.93 |

| Source: RmoneyIndia research team compilation |

The tax benefits of investing in money market mutual funds

Keeping track on costing part of your investment is very important. it helps in realising actual returns from your investments. Beside charges, you need to pay taxes on your investments in money market mutual fund schemes in India. The following details will help you understand the tax liability if you plan to invest in any of the above money market mutual fund schemes –

- Long-term capital gains (LTCG) tax @20% (plus surcharge, if applicable and cess) with indexation if units held for more than 36 months

- Short-term capital gains (STCG) tax at the income tax slab rate if units are held for less than 36 months

- You do not need to pay any tax on dividends. However, a Dividend Distribution Tax (DDT) is deducted at source @29.12% ( 25% + 12% surcharge + 4% Health & education cess) on behalf of retail individual investors.

- You must note that other than retail investors this rate is 34.944% ( 30% + 12% surcharge + 4% Health & education cess).

- The DDT is to be paid by the mutual fund after grossing-up income distributed to the investor.

- Further, if you are an NRI investor, the LTCG tax is chargeable @ 10% (plus surcharge, if applicable and cess) without indexation relating to units redeemed from unlisted schemes.

Stock Trading Now trade in ₹9 Per Order or ₹ 999 Per Month Plans.

Future & Options Access F&O contracts with advanced tools for hedging and speculation.

Currency Trading Trade in major currency pairs and manage forex exposure efficiently.

Commodity Trading Diversify Trading with MCX & NCDEX by Trading in Gold, Silver, Base Metals, Energy, and Agri Products.

Margin Trading Funding Boost your buying power with upto 5X, Buy now Pay Later

Algo Trading Back test, Paper Trade your logic & Automate your strategies with low-latency APIs.

Trading View Leverage Trading View charts and indicators integrated into your trading platform.

Advanced Options Trading Execute multi-leg option strategies with precision and insights.

Stock Lending & Borrowing Earn passive income by lending stocks securely through SLB.

Foreign Portfolio Investment Enable NRIs and FPIs to invest in Indian markets with ease and compliance.

IPO Invest in upcoming IPOs online with real-time tracking and instant allotment updates.

Direct Mutual Funds 0% Commissions by investing in more than +3500 Direct Mutual Fund Scheme.

Corporate FDRs Earn fixed returns with low-risk investments in high-rated corporate fixed deposits.

Stocks SIPs Build long-term wealth with systematic investment plans in top-performing stocks.

Bonds & NCDs Access secure, fixed-income investments through government and corporate bond offerings.

Depository Services Safely hold and manage your securities with seamless Demat and DP services with CDSL.

Journey Tracing our growth and milestones over time.

Mission & Vision Guided by purpose, driven by long-term vision.

Why RMoney Platform Smart, reliable platform for all investors' needs.

Management Experienced leadership driving strategic financial excellence.

Credentials Certified expertise with trusted industry recognition.

Press Release Latest company news, updates, and announcements.

Testimonials Real client stories sharing their success journeys.

7 Reasons to Invest Top benefits that make investing with us smart.

SEBI Registered Research Trusted insights backed by SEBI-compliant research.

Our Technology Advanced tools enabling efficient online trading.

Calculators Access a suite of smart tools to plan trades, margins, and returns effectively.

Margin Calculator Instantly check margin requirements for intraday and delivery trades.

MTF Calculator Calculate MTF funding cost upfront to ensure full transparency before placing a trade.

Brokerage Calculator Know your exact brokerage charges before placing any trade.

Market Place Explore curated investment products and trading tools in one convenient hub.

RMoney Gyan Enhance your market knowledge with expert blogs, videos, and tutorials.

Performance Tracker Track our research performance with full transparency using our performance tracker.

Feedback Share your suggestions or concerns to help us improve your experience.

Downloads Access important forms, software, and documents in one place.

Locate Us Find the nearest RMoney branch or service center quickly.

Escalation Matrix Resolve issues faster with our structured support escalation process.

Back Office Log in to view trade reports, ledger, and portfolio statements anytime.

Account Modification Update personal or bank details linked to your trading account.

Fund Transfer Transfer funds instantly online with quick limit updation to your trading account.

Bank Details View our registered bank account details for seamless transactions by NEFT, RTGS or IMPS.

How to Apply IPO Step-by-step guide to apply for IPOs using your trading account.

RMoney Quick Mobile App Trade on-the-go with our all-in-one mobile trading app.

RMoney Quick login Quickly access your trading account through the RMoney Quick web-based trading.

RMoney Rocket Web Version Experience powerful web-based trading with advanced tools for algo traders.

RMoney Rocket Mobile Version Trade anytime, anywhere with our feature-rich mobile trading platform.