It is a growing fact that online trading is fast and inexpensive. However, there is a price associated with it. I will scrutinize the aspect of online trading vs. traditional full-service brokers to see how technology is impacting retail investors and traders. More precisely I will focus on whether technology is helping or hurting investors and traders in the Indian stock-market.

With the advent of technology in the sector, you now can place trades from anywhere without ever having to speak to a live relationship manager. The only basic requirement you will need is an internet connection and a device to support your trading terminals. However, there are limitations on the use of technology to a retail investor or trader, especially in the Indian scenario. The reality is that the speed and efficiency of online trading depend entirely on the supporting technology infrastructure.

However, such supporting technology infrastructure is still in its nascent phase of development that itself limits its full utilization. Moreover, there is a high possibility that they could malfunction at critical moments of punching your trades. Other potential areas of concern from retail investors perspective includes personalized customer service and feedback for investment decisions. Let us now explore the major limiting factors of technology in the Indian broking industry at large.

1. Technical issues pertaining to the use of technology in the stock-market

Excessive technology-based online trading is good for big players who can afford costly hardware to support such a trading system. Such a technology-based system though available for retailors is of little benefit to them. In fact, it is not very much suitable for trading and investment in the market by retail investors. In general, when there are high volumes on volatile trading days it slows processing speeds as well as information flow. This may result in substantial losses. This might be due to the fact that it will be hard to place the required buy or sell orders in such fast-moving markets.

Moreover, there is every chance for the software bugs to make hurdle while you trade online. Such bugs can lead to delays in getting price quotes and information on your order status. Thus, this also could result in trading losses. Because you might enter orders based on delayed price quotes or order-execution reports.

Furthermore, retail investors like you and me mostly depend on secondary sources of information using the internet and cellular service providers. So, if these internet and cellular services malfunctions, you would receive un-timely information or even will miss placing your critical trades.

2. Incompetent customer services by the online broking industry

The online brokers have a lean cost structure. Due to such low-cost structure, such brokers offer discounts on commissions. One of the greatest disadvantages comes out of this. You might have to wait a long time to place a trade over the phone, in a volatile market situation. As because trained and certified relationship managers cost money to the broker and they cant divert those costly relationship managers to a client who is availing the online broking services.

Suppose that you placed an order to buy some stock on a particular day in the morning. However, the market turned out to be negative and you need to exit from your position before its too late to book a hefty loss on the open position. Further, there might be a situation like your online portal malfunctions or your internet connection is down. So you need to place the exit order over the phone. But your phone call will be entertained by your online broker personal only when the relationship manager got free from their regular client. Even you might not get a chance to exit on the same day due to a high number of trades on that day resulting in heavy loss to you.

Furthermore, you might not be able to place orders over the phone like spread orders that involve options. Brokers might assign priority to high-net-worth clients and active traders, which could lengthen wait times for average investors. Also, administrative actions, such as exchanging funds between accounts or transferring positions between brokerages, might take longer time and limit your actual trading opportunities.

3. No live research support with online stock-market brokers

When you do online trading it means that you are at your own. You act as your own investment manager. Remember that such independence always has a price. There is always a lack of professional feedback loop in the online broking system. An investor with such stock-market brokers does not get a reliable sounding board for their investment decisions. Also, online stock-market brokers typically do not provide any buy-sell recommendations. As because SEBI research analysts registration and highering a team of registered research analysts cost money to stock-market brokers.

So you need to keep adequate time aside for research, such as reviewing financial statements on corporate investor relations websites and price charts on financial websites. All such services you can have easy access with a full-service stock-market broker, at your finger-tips. It is just like mutual funds that offer professional management and diversification at a reasonably very low cost if you do not have the time for adequate due diligence.

Thus, in a situation you still wants to opt for online stock-market brokers to trade with, you must have a backup internet connection in case your service provider is experiencing problems. Moreover, never call your discount broker or online broker during regular hours for any of your administrative works like transferring positions between accounts. Do always evade placing market orders in volatile markets. Such orders usually filled at unfavorable prices during volatile markets. Last but not least, review different online stock-market brokers and the brokers offering discount broking services, including comments on service levels and features, before opening your online account.

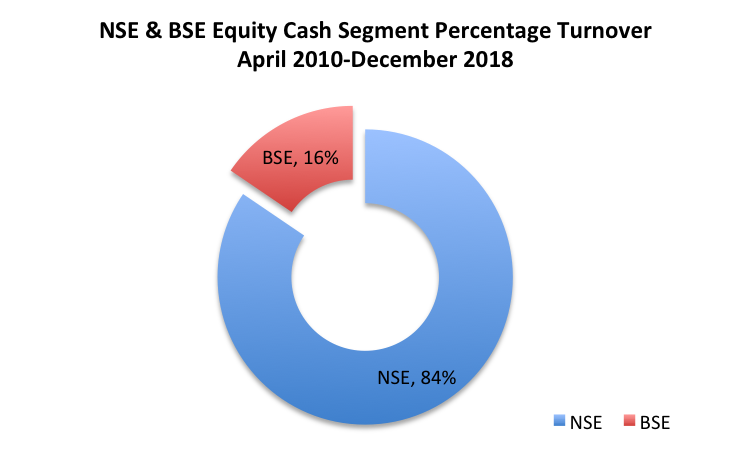

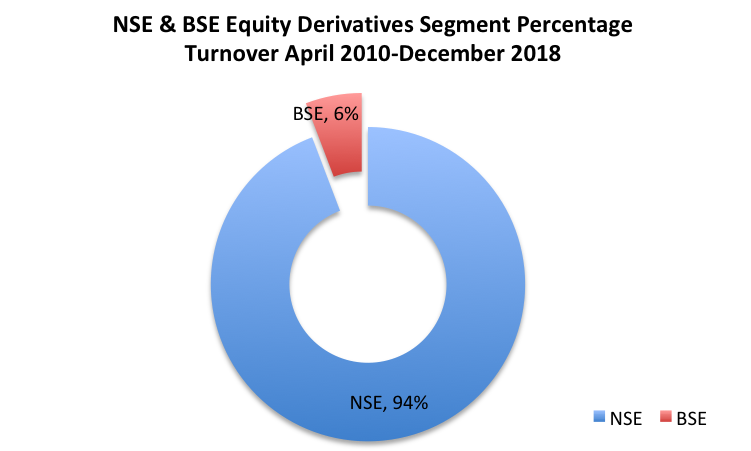

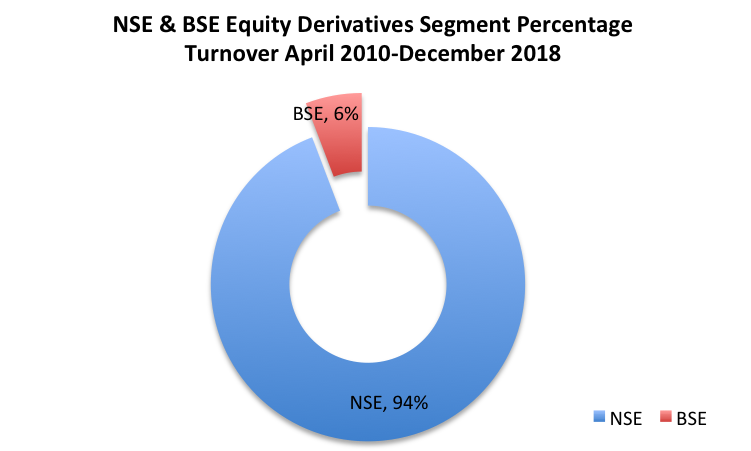

Indian retail clients inclination towards NSE in the equity market segment

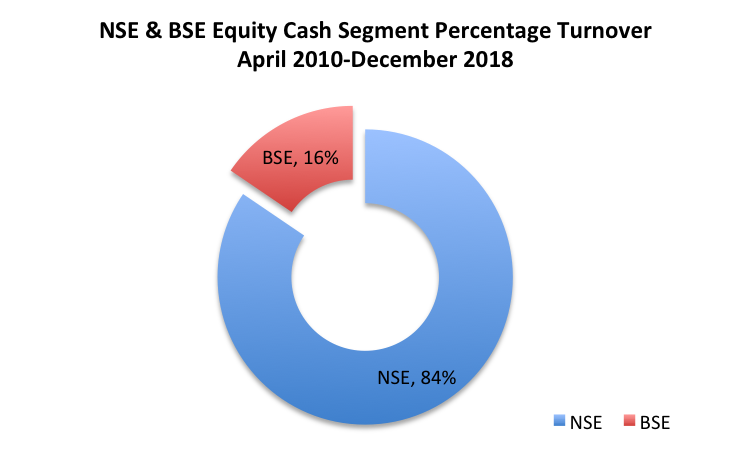

Before coming to the discussion on how technology is hurting Indian retail investors and traders, let us look into which exchange we should follow for our discussion. For this, I analyzed the total turnover in cash and derivatives segments of both national level exchange, i.e., the NSE and the BSE. I took the data that were made available to the public by SEBI for both mobile trading and internet-based trading. For internet-based trading, the data were made available as early as from April 2010. So, in order to keep thing simple, I calculated the total turnover for both the exchanges starting from April 2010 till December 2018.

As it is clear from the above pie diagram that majority of turnover in the equity cash segment is done on NSE exchange. As is with the equity derivatives segment, (the below pie chart) for the same period.

Thus, retail clients use NSE exchange heavily to trade in both equity cash and derivatives segment in India. So, I will be covering NSE exchange data in order to see how far technology is useful for an Indian retail investor. But before that, let us analyze the trends in monthly total turnover in both equity cash and derivatives segment of NSE.

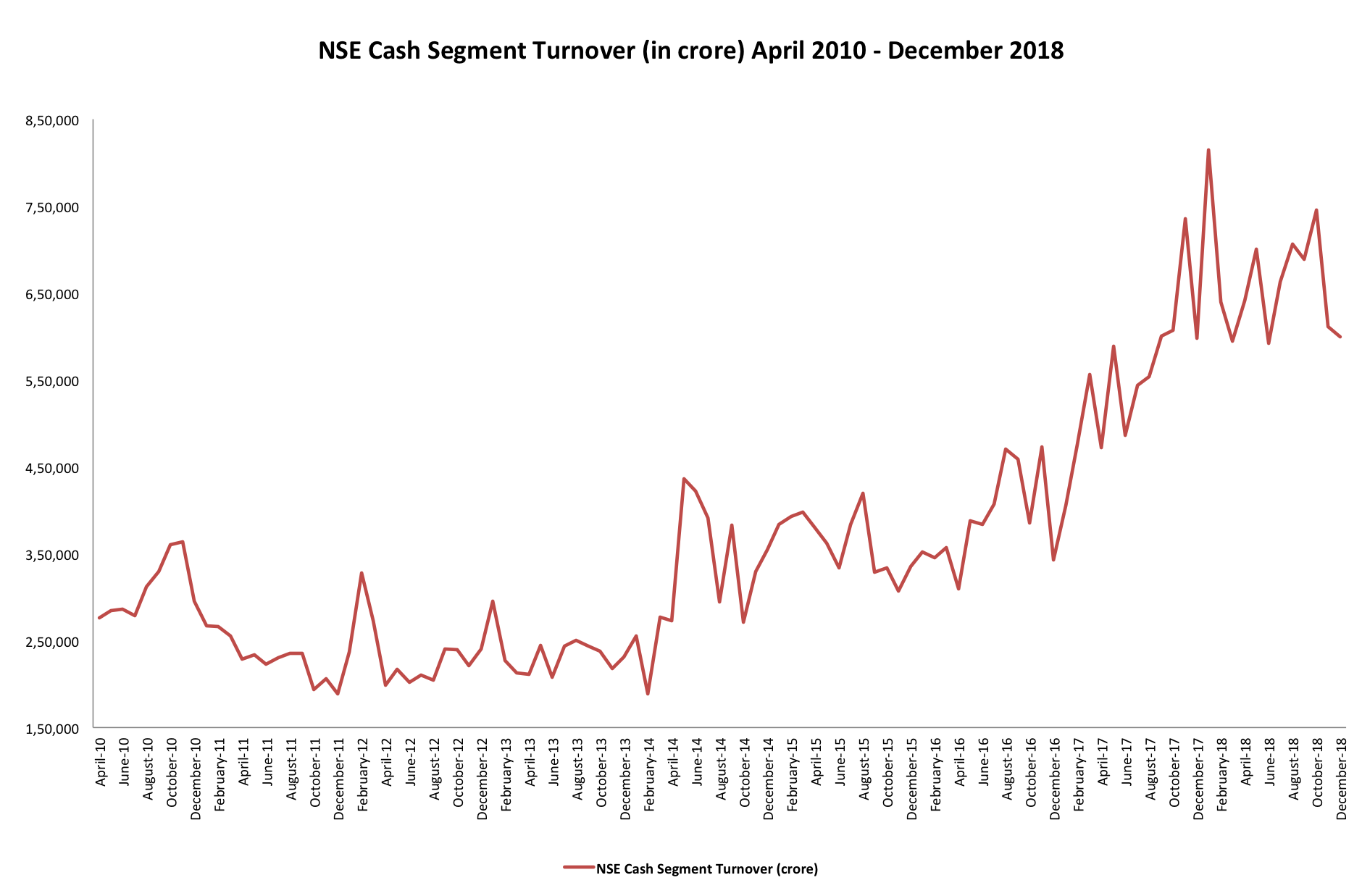

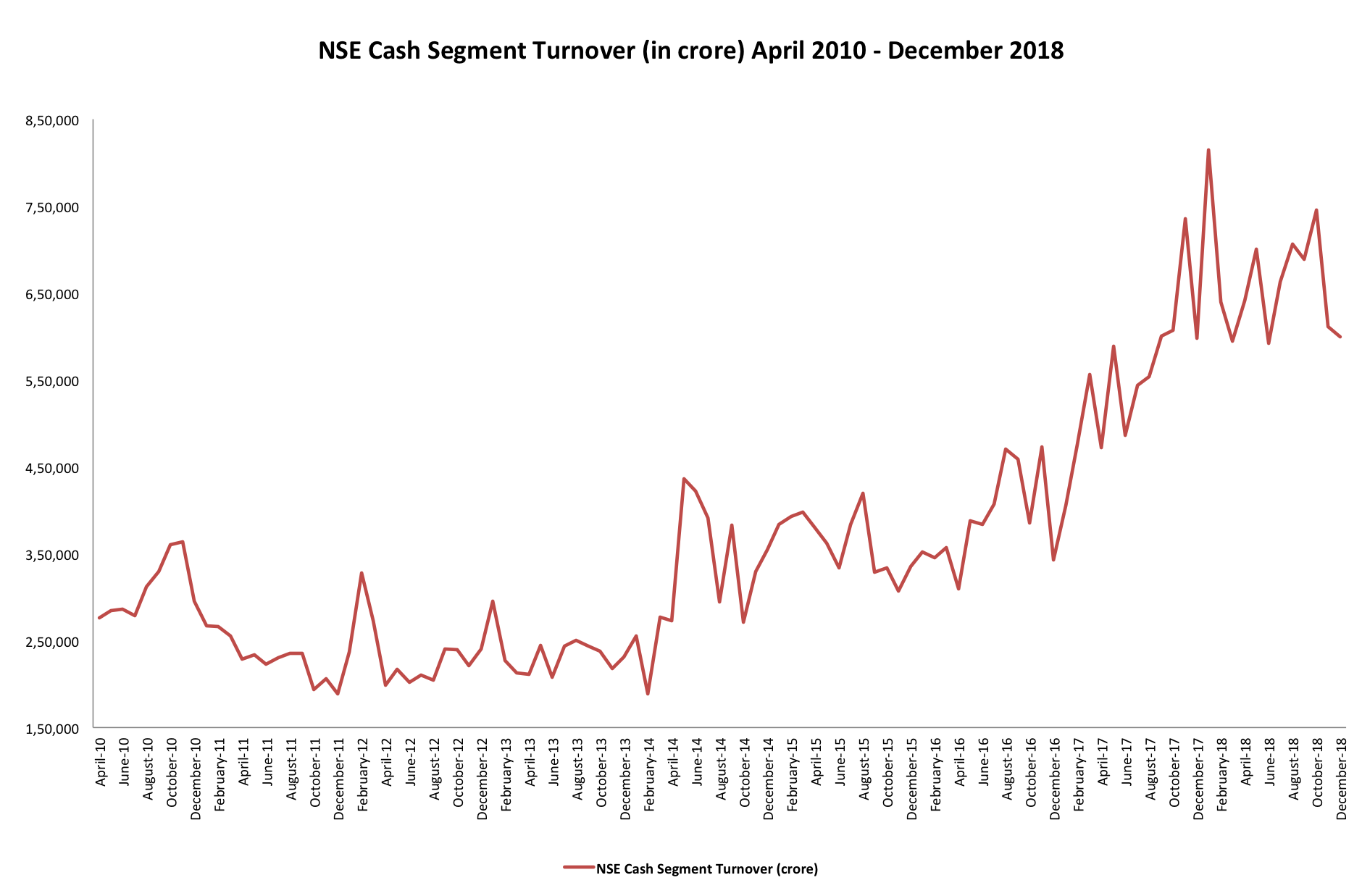

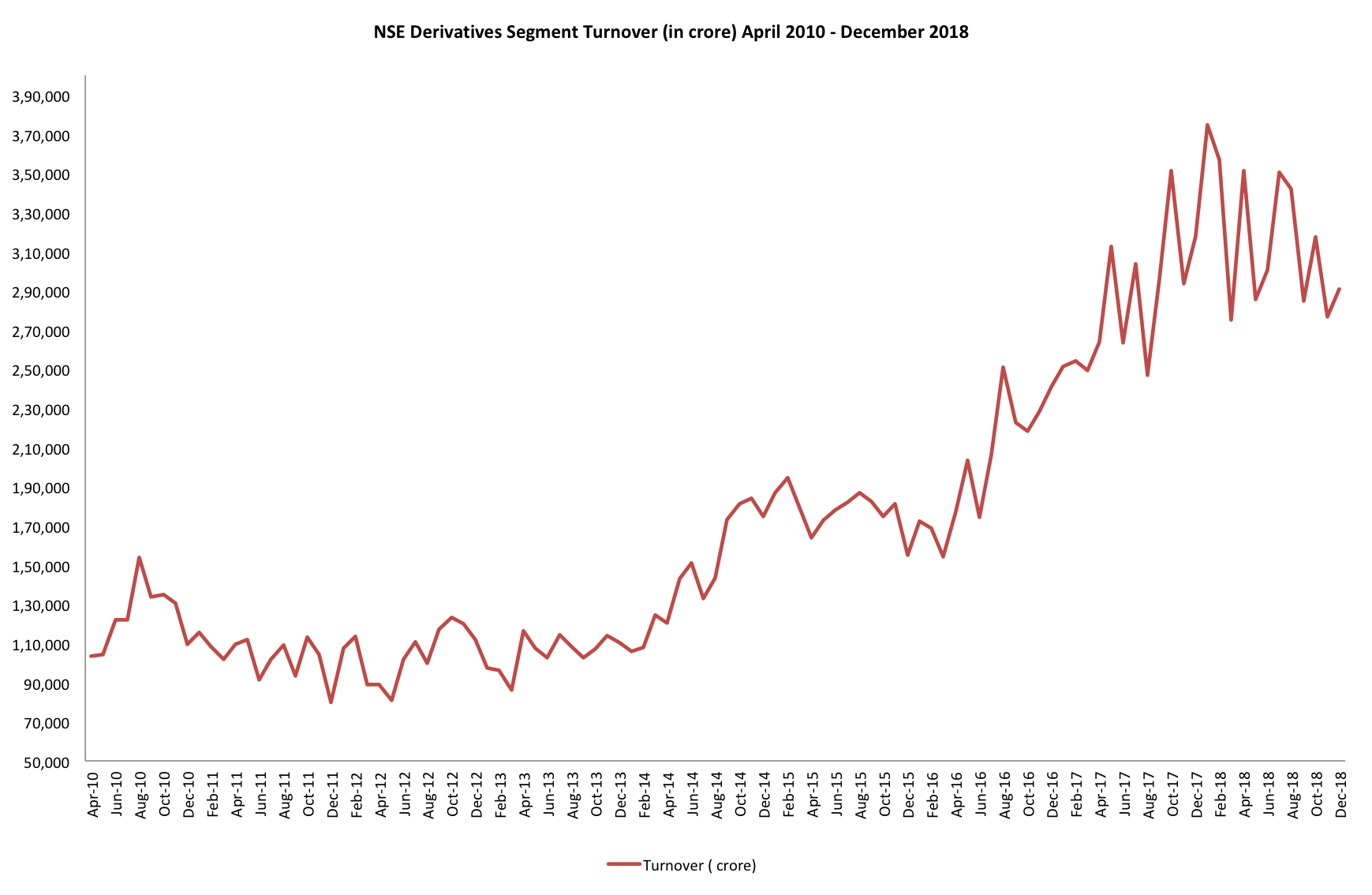

Total turnover in equity cash and derivatives segment of NSE

The following line graph depicts the month-wise total turnover in NSE equity cash segment from April 2010 till December 2018. total will help us do the same. The graph clearly indicates a massive jump in turnover starting from the start of 2014. It almost doubled from what was it in April 2010.

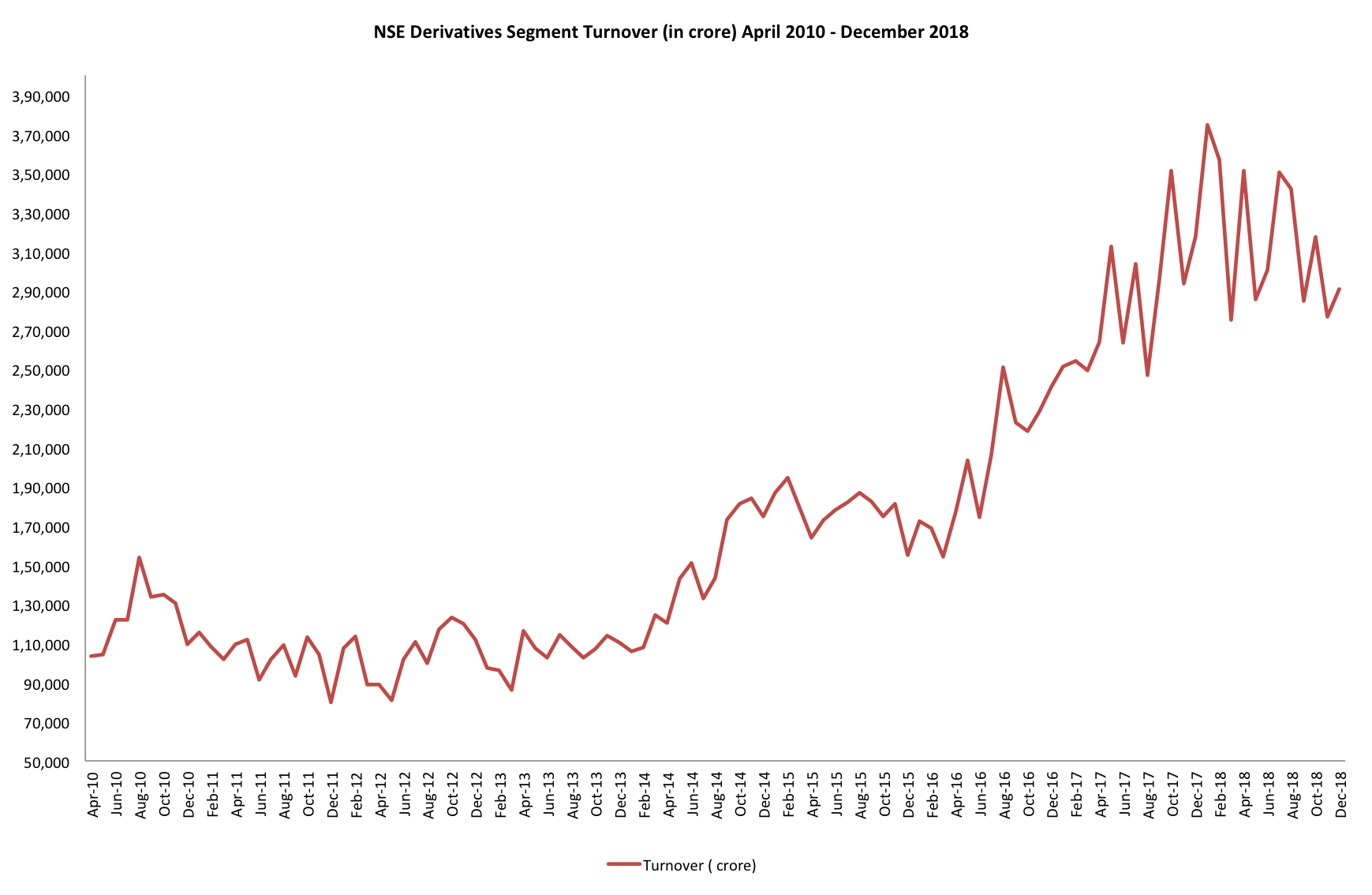

Like in NSE equity cash, the equity derivatives segment also witnessed a sharp rise in turnover, especially after mid of 2016 till almost mid of 2018. Though, roughly the derivatives segment turnover remains almost half of that of the cash segment turnover for the entire period of time, starting from April 2010.

But the question is whether retail investors and traders are benefiting out of such a rise in turnover over the period of time? To answer this we first look at what are the various available mode of trading on the NSE platform. In the next section, we will be discussing this.

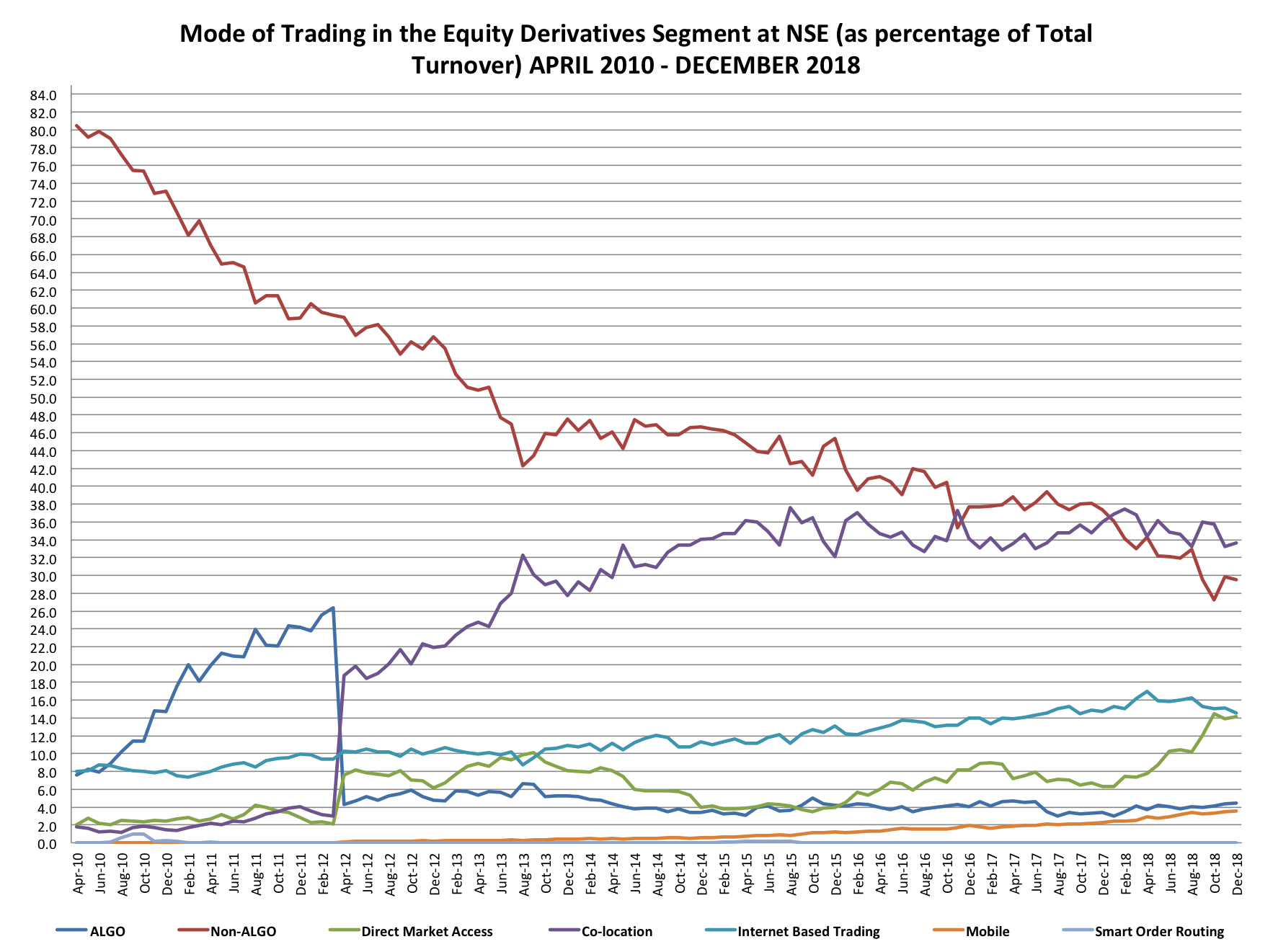

The available mode of trading in National Stock-Exchange, India

As per the available source of the exchange, the mode of trading is grouped in the following seven categories –

- Algo

- Non-algo

- Direct market access

- Co-location

- Internet-based trading

- Mobile and

- Smart order routing

Beside internet-based trading and mobile trading retail investors and traders can use a non-algo mode of trading. Rest of the other mode of trading is not meant for small retail investors and traders. This is mainly due to the fact that other mode of trading involves high usage and maintenance costs and so is outside the reach of retail clients.

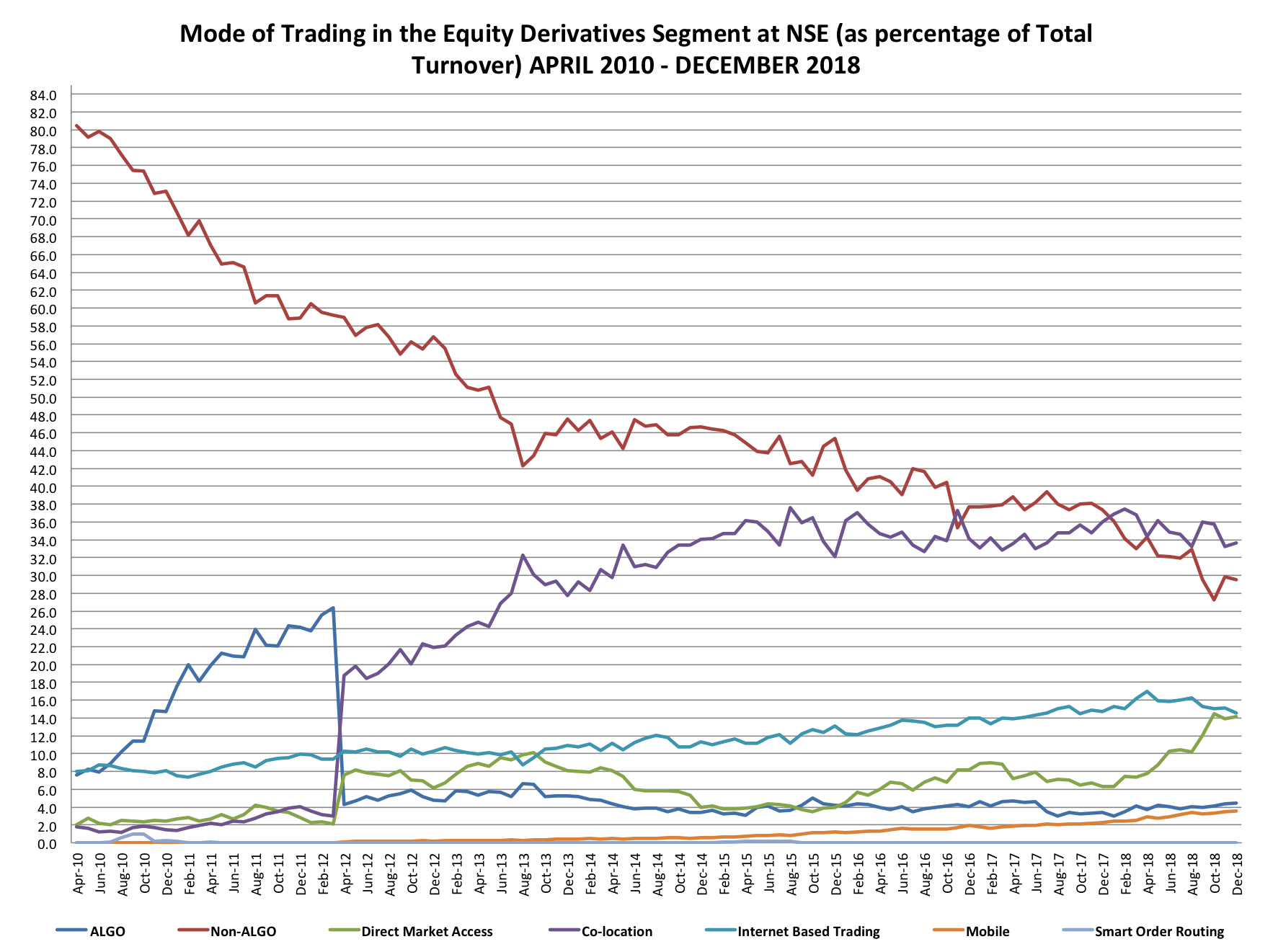

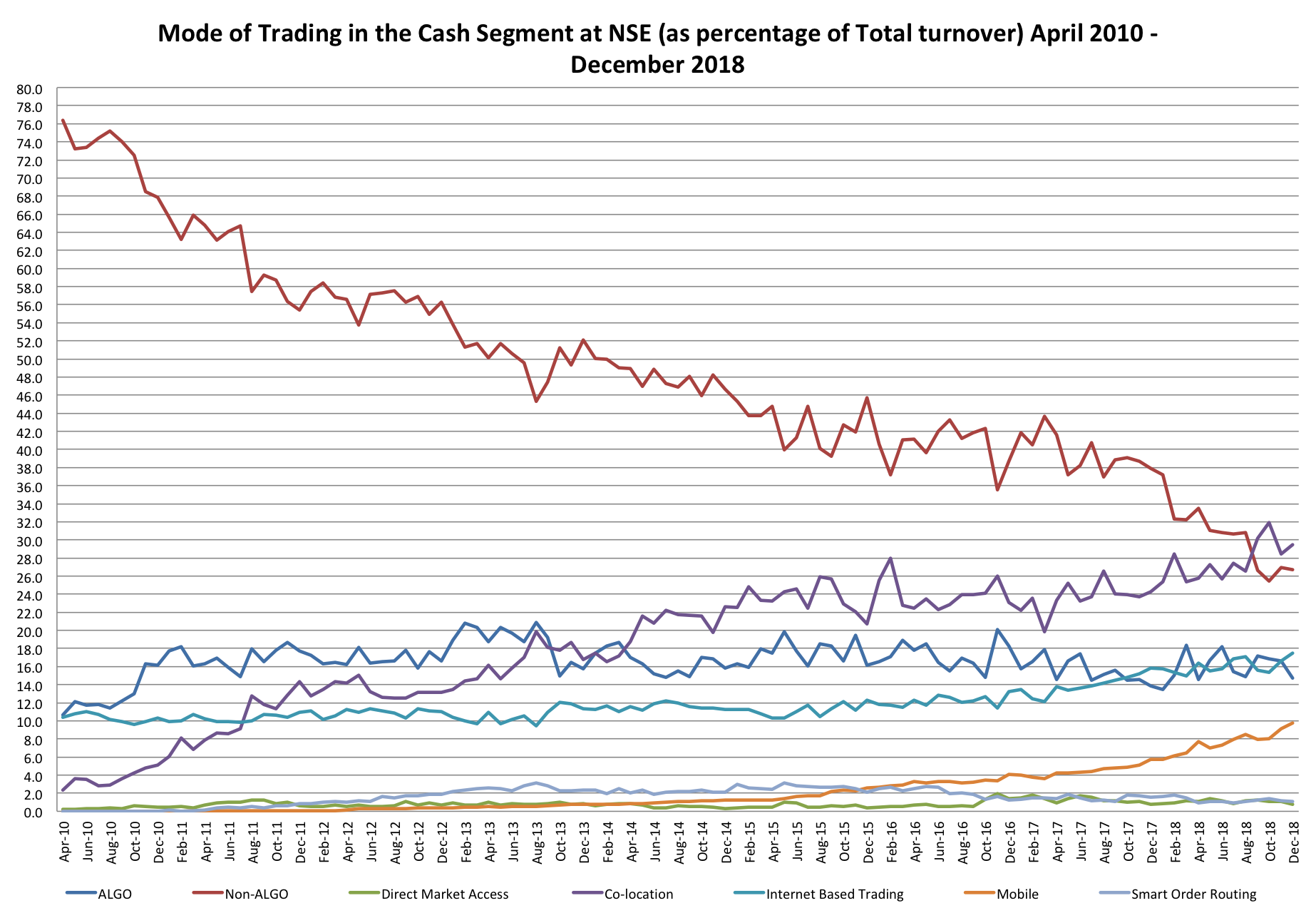

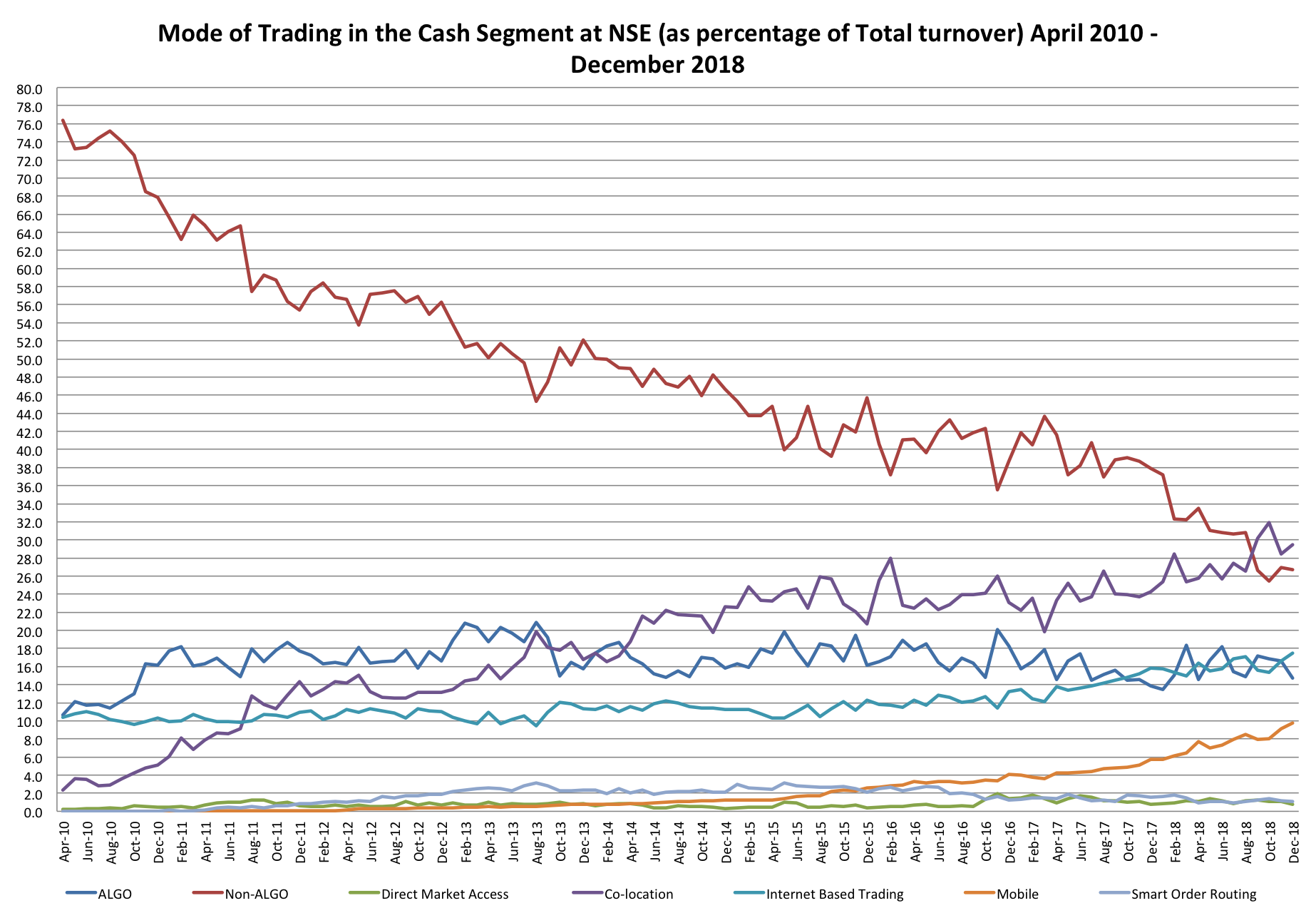

From both of the historical line graph below, one thing is clear, that traditional non-algo mode of trading is being taken over by new and innovative technology-based trading modes. Now the question is what mode retail investors and traders prefer in both cash and derivatives segment. Shortly, I will answer this, but before that let us analyse the shift in the use of the mode of trading in India.

1. Retail participants in India prefer internet-based trading over mobile trading in the derivatives segment

In the derivatives segment, co-location mode of trading is the largest beneficiary of the latest technology. After it comes internet-based trading. In almost a decade there is a fall in non-algo based trading (80% in 2010) to almost below 30% in 2018. While the colocation based trading captured almost 30% in 2018 from below 2% in 2010 of total derivatives trading volume in India. Rest all technology-based trading mode remains below 20% in 2018. Direct market access gaining huge momentum lately while internet-based trading moving steadily up year by year.

Internet-based trading gained 8% while mobile trading around 4% during the same period, respectively. Retail traders and investors rely on both of these technology-based trading systems other than non-algo based trading. Thus, retail traders prefer internet trading over mobile trading in the derivatives segment in India.

2. Retail participants in India have a similar preference for both internet-based trading and mobile trading in the cash segment

In NSE case segment also the shift from non-algo to co-location based trading mode was the same. From 76% in 2010 non-algo based trading volume declined to around 26% in 2018. While colocation based trading volume rose from 2% in 2010 to almost 30% in 2018.

However, in both internet-based and mobile trading volume during the same period rose by almost 8% each. For this, it is safe to conclude that retail investors and traders have equal preference for internet and mobile trading when it comes to case segment.

We now know the preference of retail investors and traders on the use of the technology-based mode of trading. Momentarily, I will present the case that whether the use of technology is helping or hurting the retail investors and traders.

Dependence on technology is hurting India retail investors & traders?

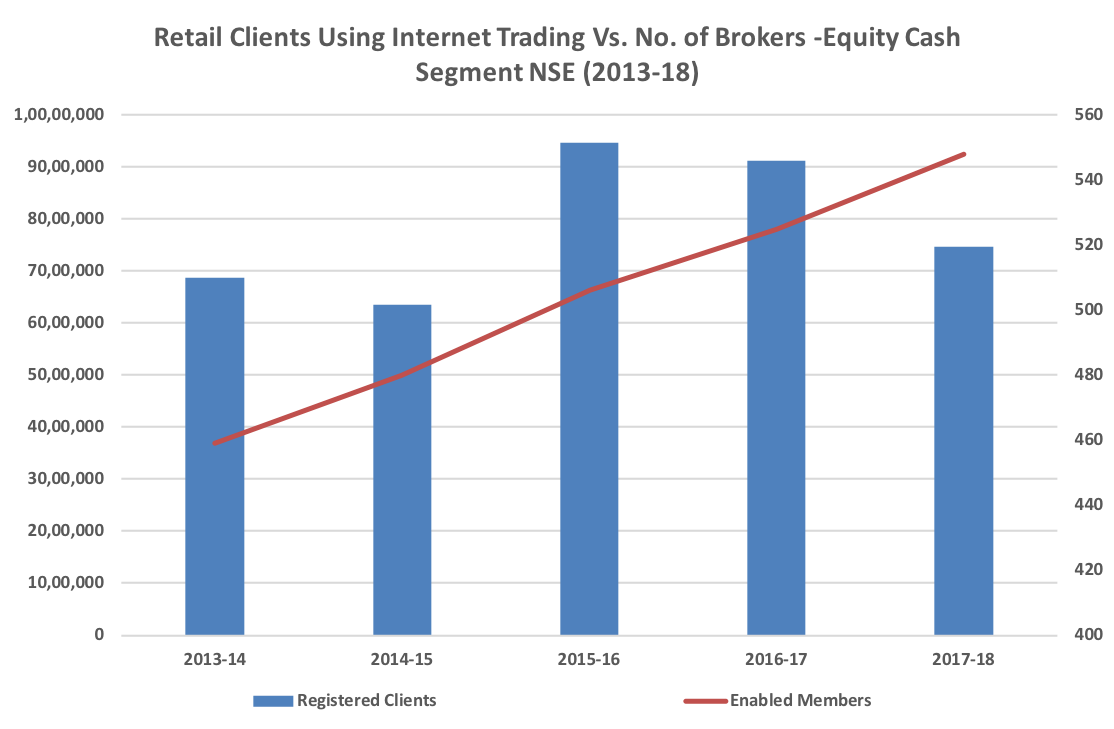

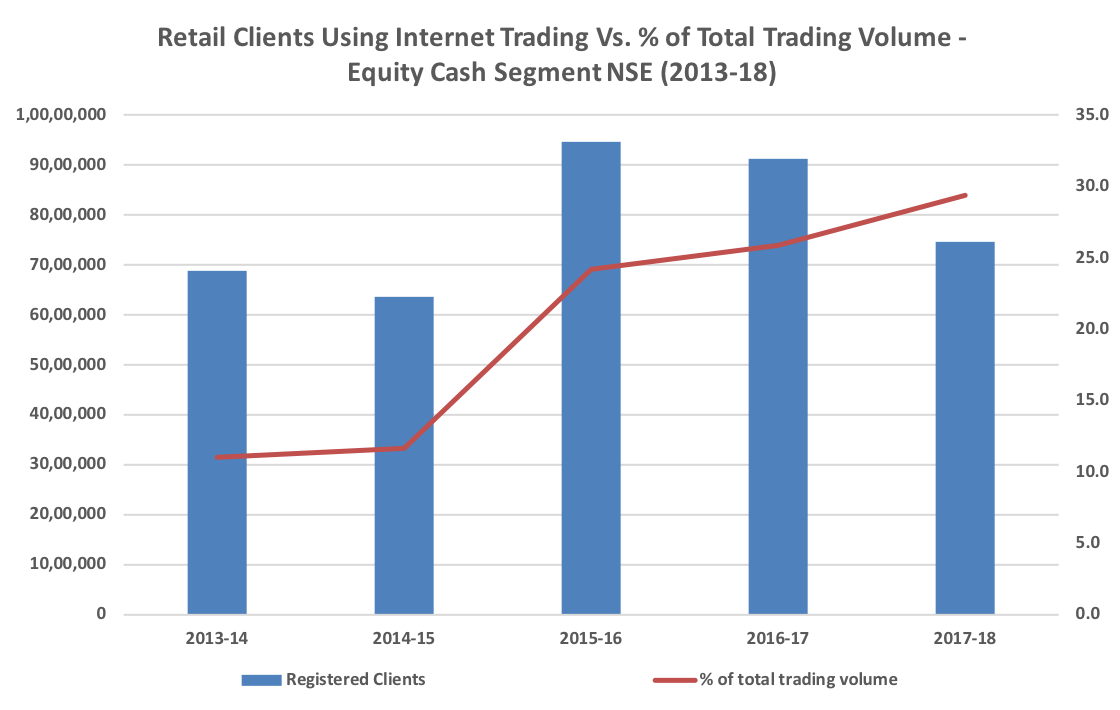

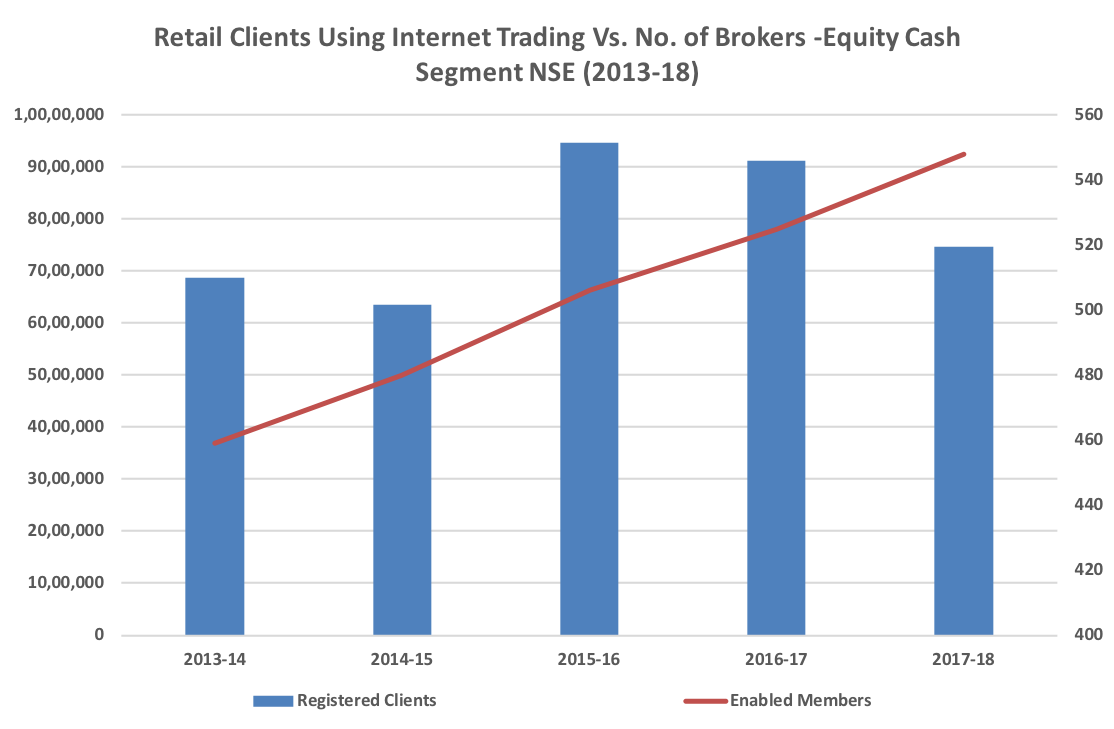

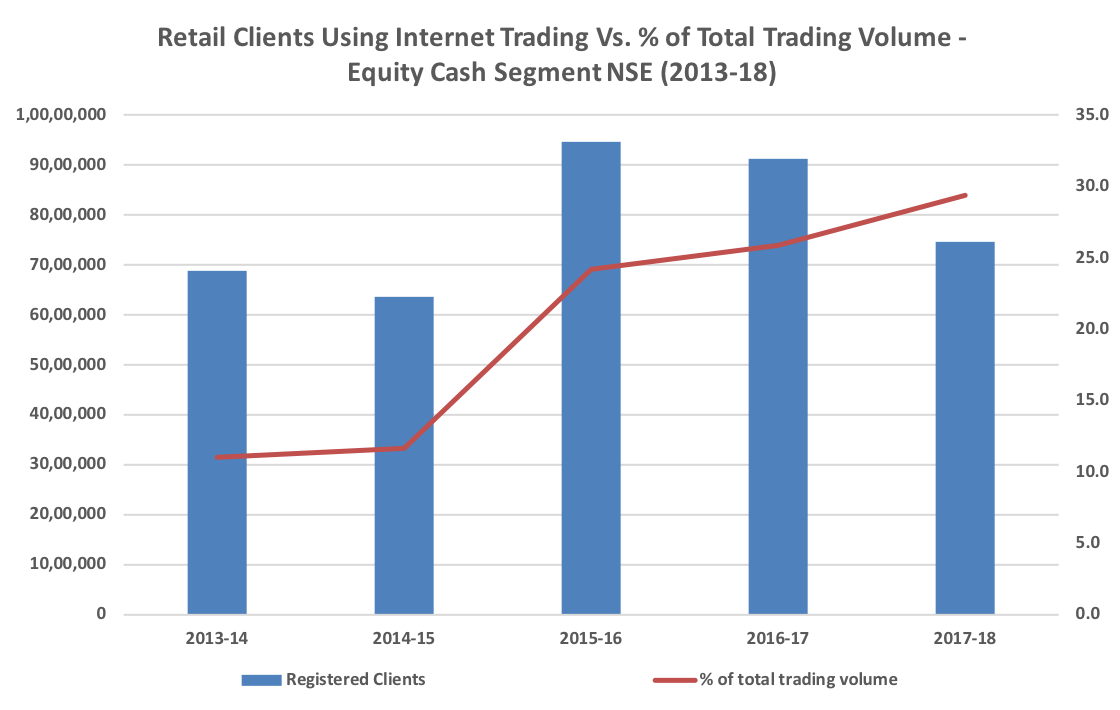

Yes, this is very much true. Yes and yes. Dependence on technology in actual is hurting both investors and traders in India. The historical data in itself speaks of this very fact. But first, look at the broker-client (retail) movement. Over a period of time, the number of registered retail stockbrokers in India is on rising. But at the same time, it is not true for retail clients. After 2015, there is a sharp fall in retail clients, both traders, and investor. From 2017, there is almost 18% of retail clients exited from the Indian stock-market.

Now, how to justify the fall in the retail client on one hand and rise in a total turnover on the other. Actually, this justifies why the retail client is out from the stock-market. See, when there is profit from your trading or investment, why would you exit from the business?

Hope you got the answer!!!

High trading volume with retail clients exiting market suggests that those exiting the market is loosing. Not only losing. But losing heavily to such an extent that they are unable to maintain their trading or investment business.

I am not denying that using technology is completely harmful. It is useful only if you have the proper knowledge and adequate supporting system to use them. And believe me, the infrastructure at the hands of retail clients is not at par. So that they can rely completely on it. Moreover, the stock-market business moves very fast. And at lest traditional broking still has an adequate support system at their premise. System to cater technology need of any retail clients. Such support still has limitation and is out of reach over mobile or internet.

About Author

Stock Trading Now trade in ₹9 Per Order or ₹ 999 Per Month Plans.

Future & Options Access F&O contracts with advanced tools for hedging and speculation.

Currency Trading Trade in major currency pairs and manage forex exposure efficiently.

Commodity Trading Diversify Trading with MCX & NCDEX by Trading in Gold, Silver, Base Metals, Energy, and Agri Products.

Margin Trading Funding Boost your buying power with upto 5X, Buy now Pay Later

Algo Trading Back test, Paper Trade your logic & Automate your strategies with low-latency APIs.

Trading View Leverage Trading View charts and indicators integrated into your trading platform.

Advanced Options Trading Execute multi-leg option strategies with precision and insights.

Stock Lending & Borrowing Earn passive income by lending stocks securely through SLB.

Foreign Portfolio Investment Enable NRIs and FPIs to invest in Indian markets with ease and compliance.

IPO Invest in upcoming IPOs online with real-time tracking and instant allotment updates.

Direct Mutual Funds 0% Commissions by investing in more than +3500 Direct Mutual Fund Scheme.

Corporate FDRs Earn fixed returns with low-risk investments in high-rated corporate fixed deposits.

Stocks SIPs Build long-term wealth with systematic investment plans in top-performing stocks.

Bonds & NCDs Access secure, fixed-income investments through government and corporate bond offerings.

Depository Services Safely hold and manage your securities with seamless Demat and DP services with CDSL.

Journey Tracing our growth and milestones over time.

Mission & Vision Guided by purpose, driven by long-term vision.

Why RMoney Platform Smart, reliable platform for all investors' needs.

Management Experienced leadership driving strategic financial excellence.

Credentials Certified expertise with trusted industry recognition.

Press Release Latest company news, updates, and announcements.

Testimonials Real client stories sharing their success journeys.

7 Reasons to Invest Top benefits that make investing with us smart.

SEBI Registered Research Trusted insights backed by SEBI-compliant research.

Our Technology Advanced tools enabling efficient online trading.

Calculators Access a suite of smart tools to plan trades, margins, and returns effectively.

Margin Calculator Instantly check margin requirements for intraday and delivery trades.

MTF Calculator Calculate MTF funding cost upfront to ensure full transparency before placing a trade.

Brokerage Calculator Know your exact brokerage charges before placing any trade.

Market Place Explore curated investment products and trading tools in one convenient hub.

RMoney Gyan Enhance your market knowledge with expert blogs, videos, and tutorials.

Performance Tracker Track our research performance with full transparency using our performance tracker.

Feedback Share your suggestions or concerns to help us improve your experience.

Downloads Access important forms, software, and documents in one place.

Locate Us Find the nearest RMoney branch or service center quickly.

Escalation Matrix Resolve issues faster with our structured support escalation process.

Back Office Log in to view trade reports, ledger, and portfolio statements anytime.

Account Modification Update personal or bank details linked to your trading account.

Fund Transfer Transfer funds instantly online with quick limit updation to your trading account.

Bank Details View our registered bank account details for seamless transactions by NEFT, RTGS or IMPS.

How to Apply IPO Step-by-step guide to apply for IPOs using your trading account.

RMoney Quick Mobile App Trade on-the-go with our all-in-one mobile trading app.

RMoney Quick login Quickly access your trading account through the RMoney Quick web-based trading.

RMoney Rocket Web Version Experience powerful web-based trading with advanced tools for algo traders.

RMoney Rocket Mobile Version Trade anytime, anywhere with our feature-rich mobile trading platform.