Investing money keeping in view the timely requirement of it, is very critical for retail investors in India. For a long-term purpose, there are a handful of options available to such retailers in India. But when it comes to investing for the short-term period, there are very few instruments available to them. Besides a few options, there is also lack of awareness relating to the availability of instruments for short duration investments. Instruments of the money market are basically short-term investment vehicles.

In order to understand the structure of money market in India, you can refer to our exclusive blog, “Learn about the money market – its concept, meaning, and functions“. In this blog, we exclusively covered the very basics of money market structure in India. You will get to know about the various segments of the money market that is operational in India. Also, the structural working of the organized money market, different instruments of the Indian money market is also present. Besides a glimpse of a brief discussion on the functions of Indian money markets is there. Along with a brief discussion on the DFHI is also there.

Now coming to the present blog, I will discuss why knowledge of money market is of prime importance to retail investors. The era in which we are living extends an era of high uncertainty. Thus, while discussing, we will cover risks associated with the money market. We also examine the advantages of the money market and their disadvantages from the retail investors’ point of view.

Hence, after going through the present blog, it will be easy for you to decide whether you need a money market instruments in your financial portfolio or not.

Enjoy reading!!!

What is the money market?

“Money market in India refers to short-term funds with maturity varying from overnight to one year in India including financial instruments that are the nearby replacement of money.” This is, in fact, money market definition by RBI (the Reserve Bank of India).

The role of money market instruments in India is same as it serves in other developed economies. It facilitates the transfer of money quickly from one economic unit to another. usually the quantum of money involved in money market transactions are very huge and the transaction costs are comparatively very low.

Economic units include business, government, banks, non-banks, and others. Also, the transaction period is relatively short than other financial instruments. Since such money market instruments are highly liquid in nature so it is considered as good as money at hand.

What are some of the examples of a money market in India?

The RBI do the operations in the following instruments of the money market in India –

Overnight Segment

- Call Money

- CBLO

- Market Repo

- Repo in Corporate Bond

Term Segment

- Notice Money

- Term Money

- CBLO

- Market Repo

- Repo in Corporate Bond

However, form any retail investors point of view instruments of the money market consists of the following –

- Call/Notice/Term money market

- Repurchase Agreement (Repo & Reverse Repo) market

- Treasury bill market

- Commercial paper market

- Certificate of Deposit market

- Money Market Mutual Fund.

- Cash Management Bill (CMB)

- Non-Convertible Debentures

Some instruments are available directly retail investors and if not so then through hybrid financial instruments like schemes of mutual funds.

Characteristics of a developed money-market

A developed commercial banking system

For a developed money market the banking system of the country must be well-developed and organized. In any economy, commercial banks are the most important suppliers of short term funds. Further, the commercial banks must also be intimately related to the central bank, so they provide a better link between the central bank and other components of money supply and borrowers, brokers, discount houses and acceptance houses.

In India, we have organized and developed commercial banks have reached in urban areas. In rural areas, the unorganized money market still prevails because of indigenous bankers, money lenders, Marwari and Multani. So overall money market in India is not well-organized due to the less developed commercial banking system.

Presence of an apex central bank

In a developed money market, there is always an apex central bank. The central bank provides the ultimate liquidity without which a money market cannot function efficiently. As a matter of fact, the central bank is the reservoir of all types of funds short, medium and long term. Moreover, the central bank controls regulate and guide the money market.

However, in India due to the presence of indigenous bankers, the adoption of effective monetary policy or controls is lacking. This further hurdles the full development of the money market.

Presence of fully functional sub-markets

For the proper functioning of the money market, it needs developed and sensitive submarkets. In fact, a money market is a group of various sub-markets, each one dealing in loans of various maturities. There are sub-markets for call loans, the collateral loans, acceptances, foreign exchange, bills of exchange and commercial and treasury bills.

If these sub-markets are non-existent or there is less responsiveness to small changes in the interest an discount rates, it means under no circumstances a money market will be developed. There must be a large number of dealers and bidders in different sub-markets. The larger the number of sub-markets, the broader and more developed will be the structure of the money market. Besides, such sub-markets must be integrated with each other.

It means that if the interest rate is high in one market, the borrowers will move to sub-markets where the interest rate is low. The lenders, in this case, will move to those sub-markets which can provide them higher interest rate. Thus it will facilitate the mobilization of resources from one market to another.

However, in India, various sub-markets are either non-existent or not integrated. There is a lack of coordination and integration among different sub-markets. The interest rates in different submarkets in India vary considerably. The undeveloped money market does not possess all the important and essential sub-markets, particularly the bill market. However, in recent years greater integration in various markets has been observed.

Availability of near money asset class

In a developed money market, a variety of financial instruments such as bills of exchange, treasury bills, promissory notes, short-dated government bonds, etc should be present. If the number of near money assets is more, the money market will be more developed.

The bills are drawn in a standard form and are accepted and discounted. The money market should have a regular supply of these assets. There should also be a large number of people desirous of buying and selling these credit instruments.

If the near-money assets or credit instruments are not available in sufficient number, the money market cannot be developed. It is the dealers in near money assets who actually infuse life into the money market.

Availability of ample resources

Another feature of a developed money market is the availability of ample resources. A developed money market has easy access to financial resources from both within and outside the country.

People in foreign countries think it safe and profitable to invest money in highly liquid assets in developed countries. It is the availability of cheap facilities for the remittance of funds from one place to another which has resulted in raising the resources. Availability of ample funds is essential for the smooth and efficient working of the money market.

Underdeveloped money markets do not attract foreign funds, may be due to political instability and the absence of stable exchange rates.

Integrated interest-rate structure

Last but not least, a developed money market is that it has an integrated interest rate structure. To clarify it, a change in the bank rate results in an equi-proportionate change in the interest rates which exist in cases of different sub-markets. It is due to this structure of interest rates that the central bank can exercise control on the functioning of the money market.

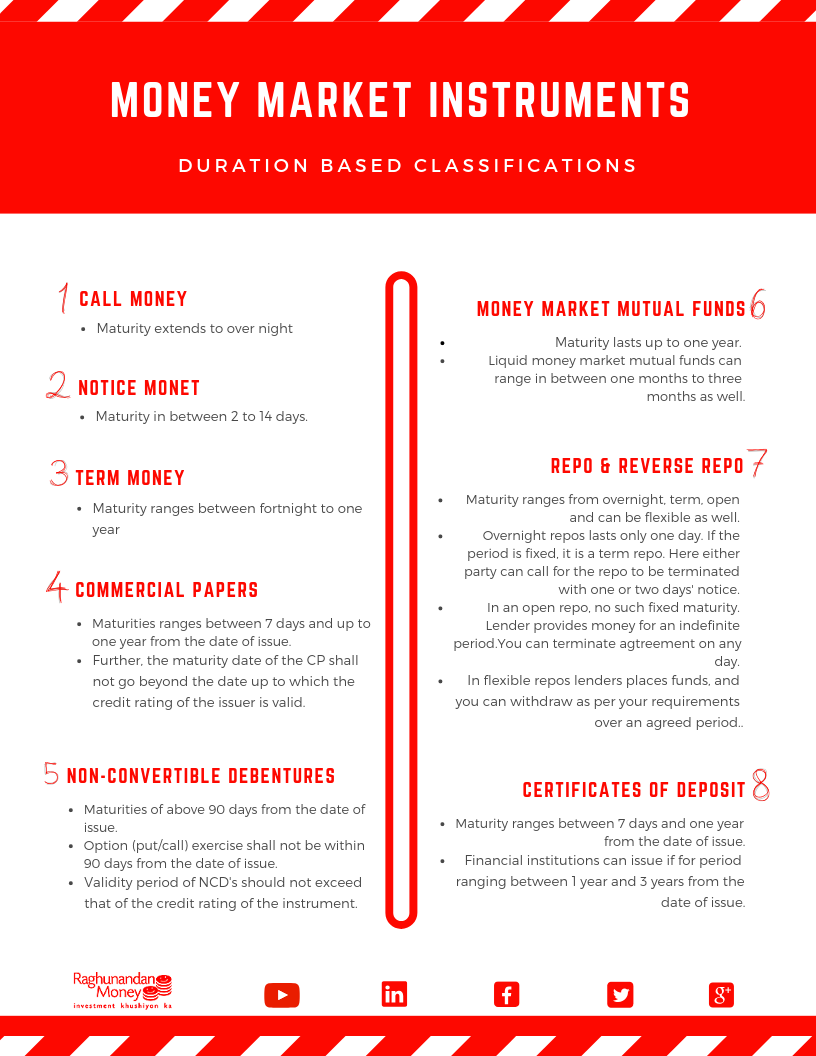

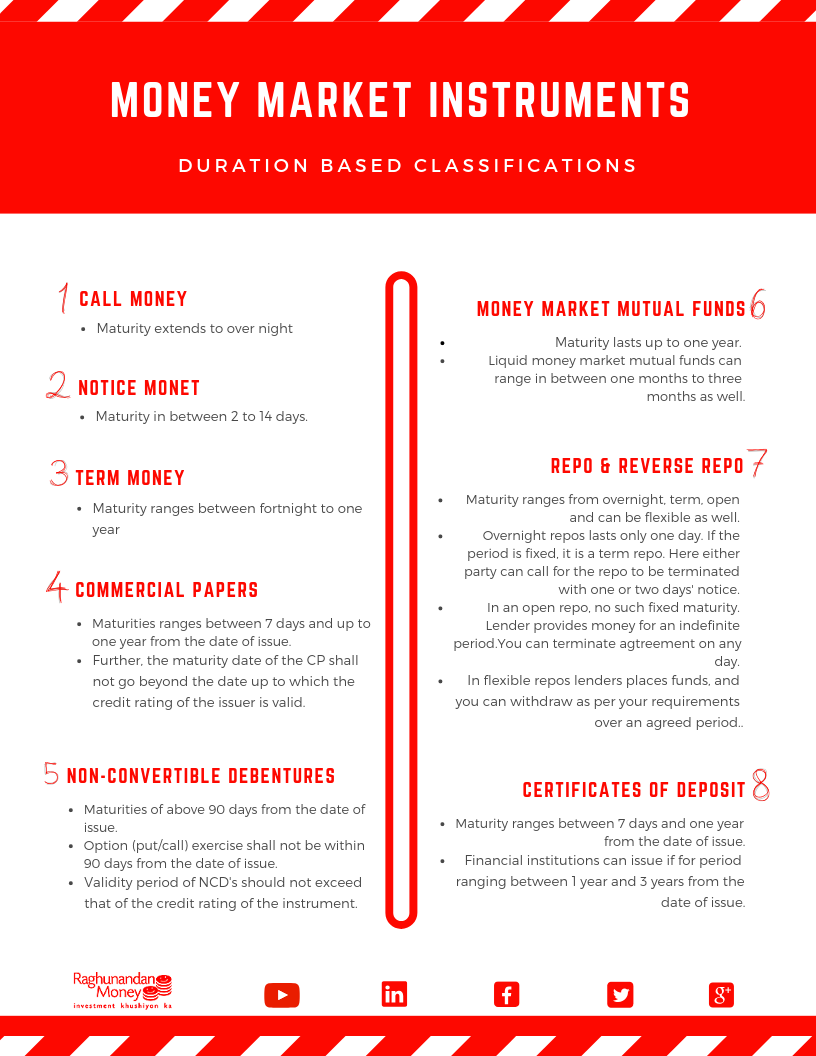

A brief description of instruments of the money market

As per RBI, financial instruments that deal in overnight funds comes under “Call Money’. While “Notice Money” deals with financial instruments covering funds for two to fourteen days. Similarly, instruments under “Term Money” deal in funds for fifteen days to one year. A brief discussion on the duration based classification of money market instrument is there in the below infographics.

In order to suck out excess liquidity from the economy as a whole, the RBI uses methods such as OMO (open market operations, CMB (cash management bills), T-Bills (treasury bills), variable repo rates and reverse repo rates. The Cash management bills is an instrument at the hands of the central bank to meet the immediate cash requirement of the central government.

These are in fact short-term bills. The government uses these instruments to overcome any mismatch between there short-term cash availability and usages. The very unique feature of CMBs that differentiate it from other similar instruments is that this instrument can be issued for any timeframe but will always be less than 90 days.

How does the money market work?

For any retail investor investing in any of the available money market instrument is as good as keeping cash in hand or bank. The shorter the duration of conversation of the instrument into cash without any loss, the better is the instrument from the retailer points of view. Contrary to this, from the issuer aspect, the less liquid the instrument is, the better. As they need to use the available funds under such instruments flawless during the available period. This very explanation is very helpful in understanding the very working of the money market.

Thus, for the borrowers, the money market created liquidity and funds their short-term cash flow requirements. For this, they package their requirement through various instruments under the broad guidelines of the apex bank, the RBI. These instruments we call as money market instruments. Borrowers could be either government or corporates. Lenders could be financial institutions, banks, corporates, governments, and individuals.

Notwithstanding, retail investors need to access this market only through a variety of securities. Such securities are either issues directly by the borrowers to the investors or through some intermediaries like banks mutual funds and others.

The principle on which the money market operates

At any particular given point of time within any economy, there are some who always have surplus cash for short duration. In a similar way, there are always some who require cash for a short duration. At one point in time, one can act as a supplier and at some other point of time in future, the same can become a borrower in the same market.

Thus, based on this very principle of surplus and deficit of cash in the economy, the money market functions electronically. Entities with temporary excess cash invest in short-term money market instruments. While entities with short-term cash needs sell securities on a short duration basis. For an investor the main point of attraction for such investments are –

- Income Protection,

- Capital Appreciation, and

- Tax-Exempt Savings

The risk in the money market, is there any?

Stuart Wild rightly said that risk is inherent with every money-making activity. An investment in money market instrument is no exception. Though money market investments possess a low risk when we compare with other financial asset class. Yet these, investments are not completely risk-free. Money market instruments possess the following kind of risks –

- Reinvestment risk,

- Counterparty risk,

- Instrument risk, and

- Liquidity risk

Reinvestment risk is the risk of investing maturing funds at a lower interest rate. Due to such risk, you will get a lower yield than investing in the maturing investment. Whereas counterparty risk is associated with the borrower not making timely payments. On the contrary instrument specifically refers to the risk of a particular debt instrument. Lastly, with liquidity risk, you won’t be able to sell at the desired time or at fair value.

Thus, even before you decide to park your surplus available funds for a short duration in any of the money market-based instruments, you need to keep in mind specific risk associated with them. Only when you have the knowledge for such risks, you will optimize returns at the lowest possible risk. Also, you will take the better decision to trade off the risk and return from such money market instruments. Take a look at the advantages and disadvantages of investing in the money market.

1. Advantages of money market instruments

- Suitable for those investors who focus on the preservation of their funds and seeks some returns on their investments. Thus, suitable for risk-averse investors.

- Gains in money market funds are usually tax exempt. This is so because they invest mainly in government securities. However, any dividends are taxable.

- Investments in these instruments provide a degree of safety, contrarily volatile securities markets.

- Because they are a good low-risk investment, money market funds are widely used defensive investments when the stock markets are declining.

- Such instruments have a potential stream of fixed income.

- Mutual funds schemes that deal exclusively in money market instruments provide both liquidity and safety along with income to investors. They are liquid at the investments are made in securities of short duration with a fixed nature of returns.

- Investments with such instruments have the potential of generating higher yields as and when we compare with conventional cash and cash equivalents. In India, cash equivalents are money parked in savings and current accounts at bank and post offices.

2. The disadvantages of money market investments

- Although returns on a money market fund are higher than those on a savings account, they are still much lower than returns on equities or bonds.

- Some money market securities are very costly, which makes it difficult for individual investors to purchase them.

- Your purchasing power may get a negative impact. Even if returns from these instruments is decent, you might be experiencing negative yield due to higher prevailing inflation. Higher inflation kills real earnings from such instruments.

- Such instruments issued by Indian corporates bear risks. However, securities issued by governments and semi-governments are comparatively safe. However, with risk, returns are higher with such corporate instruments.

- Your wealth creating ability might be at high risk due to a greater degree of opportunity costs associated with these instruments. As an investor, you might be missing out the opportunity for a better rate of returns from other investment options.

As an investor do you need to care for the money market in India?

Retail investors in India have very little scope to invest their short-term surpluses. The only option left with them for short duration is either to keep the surplus as cash or put it on low or no income-generating savings and current account respectively. Almost all current account with banks generates no income.

Even in the case of the shortfall from QAB (the quarterly average balance) limit you are penalized by the banks, resulting in negative returns from such holdings.

For money requirements in the longer run, Indian investors have a handful of options with them. So it is not justified to put any of your short term surpluses into any of these long-term investment options. As for example, no business mix their long-term requirements with short-term or mid-term funds requirements. Working capital is with them to take care of business short term funds requirements.

Likewise, as an investor, you also need to have an investment option that would take care of your short-term surplus funds. Investments mean some additional earnings over and above your capital investments. And here comes, the money market instruments handy.

Thus, according to me, every Indian must have adequate knowledge of the money market, the instruments of the money market along with other details of such investments. Hence, mutual funds schemes dealing exclusively with money market instruments would be a good start for any retailer.

Stock Trading Now trade in ₹9 Per Order or ₹ 999 Per Month Plans.

Future & Options Access F&O contracts with advanced tools for hedging and speculation.

Currency Trading Trade in major currency pairs and manage forex exposure efficiently.

Commodity Trading Diversify Trading with MCX & NCDEX by Trading in Gold, Silver, Base Metals, Energy, and Agri Products.

Margin Trading Funding Boost your buying power with upto 5X, Buy now Pay Later

Algo Trading Back test, Paper Trade your logic & Automate your strategies with low-latency APIs.

Trading View Leverage Trading View charts and indicators integrated into your trading platform.

Advanced Options Trading Execute multi-leg option strategies with precision and insights.

Stock Lending & Borrowing Earn passive income by lending stocks securely through SLB.

Foreign Portfolio Investment Enable NRIs and FPIs to invest in Indian markets with ease and compliance.

IPO Invest in upcoming IPOs online with real-time tracking and instant allotment updates.

Direct Mutual Funds 0% Commissions by investing in more than +3500 Direct Mutual Fund Scheme.

Corporate FDRs Earn fixed returns with low-risk investments in high-rated corporate fixed deposits.

Stocks SIPs Build long-term wealth with systematic investment plans in top-performing stocks.

Bonds & NCDs Access secure, fixed-income investments through government and corporate bond offerings.

Depository Services Safely hold and manage your securities with seamless Demat and DP services with CDSL.

Journey Tracing our growth and milestones over time.

Mission & Vision Guided by purpose, driven by long-term vision.

Why RMoney Platform Smart, reliable platform for all investors' needs.

Management Experienced leadership driving strategic financial excellence.

Credentials Certified expertise with trusted industry recognition.

Press Release Latest company news, updates, and announcements.

Testimonials Real client stories sharing their success journeys.

7 Reasons to Invest Top benefits that make investing with us smart.

SEBI Registered Research Trusted insights backed by SEBI-compliant research.

Our Technology Advanced tools enabling efficient online trading.

Calculators Access a suite of smart tools to plan trades, margins, and returns effectively.

Margin Calculator Instantly check margin requirements for intraday and delivery trades.

MTF Calculator Calculate MTF funding cost upfront to ensure full transparency before placing a trade.

Brokerage Calculator Know your exact brokerage charges before placing any trade.

Market Place Explore curated investment products and trading tools in one convenient hub.

RMoney Gyan Enhance your market knowledge with expert blogs, videos, and tutorials.

Performance Tracker Track our research performance with full transparency using our performance tracker.

Feedback Share your suggestions or concerns to help us improve your experience.

Downloads Access important forms, software, and documents in one place.

Locate Us Find the nearest RMoney branch or service center quickly.

Escalation Matrix Resolve issues faster with our structured support escalation process.

Back Office Log in to view trade reports, ledger, and portfolio statements anytime.

Account Modification Update personal or bank details linked to your trading account.

Fund Transfer Transfer funds instantly online with quick limit updation to your trading account.

Bank Details View our registered bank account details for seamless transactions by NEFT, RTGS or IMPS.

How to Apply IPO Step-by-step guide to apply for IPOs using your trading account.

RMoney Quick Mobile App Trade on-the-go with our all-in-one mobile trading app.

RMoney Quick login Quickly access your trading account through the RMoney Quick web-based trading.

RMoney Rocket Web Version Experience powerful web-based trading with advanced tools for algo traders.

RMoney Rocket Mobile Version Trade anytime, anywhere with our feature-rich mobile trading platform.