Introduction

Options trading is more than simply predicting market direction. Traders must also navigate how the risk exposure of their positions evolves as markets move. One of the most sophisticated techniques in professional options trading is gamma scalping, a strategy used to manage nonlinear risk inherent in options portfolios.

Gamma scalping sits at the intersection of delta hedging and active trading. It allows traders not only to neutralize directional exposure but also to potentially profit from price fluctuations in the underlying asset. This blog delves deeply into what gamma scalping is, why it matters, how it works in practice, and the risks and benefits associated with it.

The Greeks Refresher: Delta and Gamma

Before diving into gamma scalping, it’s essential to understand the two key Greeks involved:

Delta

- Delta measures how much the price of an option is expected to move for a ₹1 move in the price of the underlying asset, assuming all other factors remain constant.

- For example, a call option with a delta of +0.40 means that if the underlying rises ₹1, the option’s price should increase by approximately ₹0.40.

Gamma

- Gamma measures how much delta changes for each ₹1 change in the underlying asset’s price.

- A high gamma indicates that delta can shift rapidly, causing significant changes in the directional risk of the option.

- Gamma is highest for at-the-money options and tends to increase as the expiry approaches. It reflects how quickly the option’s directional sensitivity changes.

Gamma is essentially the

rate of change of delta. It is crucial because even if you initially hedge your delta exposure perfectly, movements in the underlying asset can quickly throw that hedge off balance.

What Is Gamma Scalping?

Gamma scalping is the practice of dynamically adjusting a delta-neutral options position to capture profits as the underlying asset price fluctuates. The idea is that while the trader starts with a delta-neutral position (no directional bias), price movements create temporary directional exposure. By buying low and selling high in the underlying, the trader aims to harvest small profits while rebalancing the hedge. Gamma scalping is most commonly employed by traders holding long gamma positions, meaning they benefit from volatility and price swings.

Why Gamma Scalping Exists?

Options are nonlinear instruments. A delta-neutral hedge set up at one price may become significantly unbalanced when the underlying moves, because delta changes due to gamma. For traders holding options:

- Long gamma positions (e.g., owning calls or puts) benefit from price volatility because the hedge can be adjusted profitably as the market oscillates.

- Short gamma positions (e.g., selling calls or puts) expose traders to losses from volatility because they must buy high and sell low to maintain the hedge.

Gamma scalping allows traders with long gamma to capitalize on market swings while managing risk.

How Gamma Scalping Works? A Step-by-Step Example

Let’s walk through a

practical example using rupee figures.

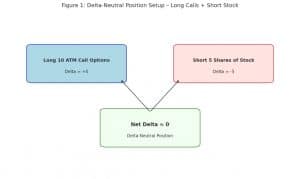

Step 1: Establishing the Position

- You buy 10 at-the-money call options on Stock XYZ.

- Each option has:

- Delta = + 0.50

- Gamma = + 0.10

- The underlying stock is trading at ₹1,000.

Your Initial Position:

- Total delta of the options:

Total Delta = 10 × 0.50 = +5

To hedge this, you short

5 shares of XYZ.

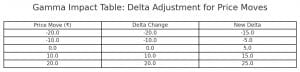

Step 2: Stock Moves Up ₹10

Stock rises from ₹1,000 to ₹1,010.

- Change in delta due to gamma:

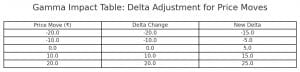

Δ Delta = Gamma × Price Move × Contracts = 0.10×10×10=+10

- New total delta: +5+10=+15

Your position is now

net long 15 shares.

Step 3: Rebalancing the Hedge

To return to delta-neutral:

- Short an additional 15 shares of XYZ.

Suppose after this, the stock falls back to ₹1,000.

- Your short shares gain ₹10 per share = ₹150 profit.

- Your options lose value as delta reduces, but:

- The profit from stock scalping exceeds the option loss because you sold higher and bought back lower.

This cycle can repeat multiple times, capturing profit from the

oscillations in the underlying asset.

Stock up → hedge adjustment → stock down → reverse hedge → net profit.

Key Benefits of Gamma Scalping

Key Benefits of Gamma Scalping

- Capturing Volatility

Gamma scalping profits from

market movement, not direction. The more the underlying asset oscillates, the greater the opportunity for profitable scalping.

- Flexibility

Gamma scalping allows traders to adjust their risk exposure continuously. It’s not a set-and-forget strategy but rather a

dynamic process.

- Limiting Directional Risk

By maintaining a delta-neutral stance, traders reduce the risk of large directional losses while still participating in price swings.

Risks and Challenges of Gamma Scalping

While gamma scalping can be profitable, it is not risk-free:

- Transaction Costs: Frequent trading in the underlying asset incurs commissions and bid-ask spreads that can erode profits.

- Volatility Risk: If the underlying asset becomes less volatile than anticipated, opportunities to scalp profitably may disappear.

- Market Gaps: Sudden large price moves can overwhelm the hedge before it’s adjusted, resulting in significant losses.

- Time Decay vs. Gamma: Gamma scalping profits must offset the option’s time decay (theta). Simply having gamma exposure is not enough, if the market doesn’t move enough, theta decay can lead to net losses.

- Gamma Behavior near Expiry: While gamma spikes for at-the-money options approaching expiry, it decreases sharply for deeply in- or out-of-the-money options and therefore strategy effectiveness can differ accordingly.

Gamma scalping is typically suitable only for sophisticated traders with the ability to monitor markets continuously and execute trades efficiently.

When Is Gamma Scalping Most Effective?

Gamma scalping works best in:

- Realised volatility is expected to exceed implied volatility.

- Markets are prone to sharp intraday swings or oscillations.

- Option premiums are priced in a way that the cost of gamma exposure (relative to expected movement) is reasonable.

Professional traders and market makers frequently employ gamma scalping to manage large options books and reduce directional risk while generating trading income.

Conclusion

Gamma scalping is an advanced yet powerful tool in the options trader’s toolkit. It transforms options’ nonlinear characteristics from a risk into a potential opportunity. By actively managing delta exposure as prices fluctuate, traders can harvest gains from volatility without committing to a directional view.

However, gamma scalping is not for every trader. It demands:

- A deep understanding of the Greeks

- Discipline in trade execution

- Constant vigilance to market conditions

For those prepared for the challenge, gamma scalping offers a sophisticated way to manage nonlinear risk and potentially enhance trading profits in volatile markets.

Disclaimer: This blog is for educational purposes only and should not be construed as investment advice. Trading derivatives involves significant risk and may not be suitable for all investors.

Stock Trading Now trade in ₹9 Per Order or ₹ 999 Per Month Plans.

Future & Options Access F&O contracts with advanced tools for hedging and speculation.

Currency Trading Trade in major currency pairs and manage forex exposure efficiently.

Commodity Trading Diversify Trading with MCX & NCDEX by Trading in Gold, Silver, Base Metals, Energy, and Agri Products.

Margin Trading Funding Boost your buying power with upto 5X, Buy now Pay Later

Algo Trading Back test, Paper Trade your logic & Automate your strategies with low-latency APIs.

Trading View Leverage Trading View charts and indicators integrated into your trading platform.

Advanced Options Trading Execute multi-leg option strategies with precision and insights.

Stock Lending & Borrowing Earn passive income by lending stocks securely through SLB.

Foreign Portfolio Investment Enable NRIs and FPIs to invest in Indian markets with ease and compliance.

IPO Invest in upcoming IPOs online with real-time tracking and instant allotment updates.

Direct Mutual Funds 0% Commissions by investing in more than +3500 Direct Mutual Fund Scheme.

Corporate FDRs Earn fixed returns with low-risk investments in high-rated corporate fixed deposits.

Stocks SIPs Build long-term wealth with systematic investment plans in top-performing stocks.

Bonds & NCDs Access secure, fixed-income investments through government and corporate bond offerings.

Depository Services Safely hold and manage your securities with seamless Demat and DP services with CDSL.

Journey Tracing our growth and milestones over time.

Mission & Vision Guided by purpose, driven by long-term vision.

Why RMoney Platform Smart, reliable platform for all investors' needs.

Management Experienced leadership driving strategic financial excellence.

Credentials Certified expertise with trusted industry recognition.

Press Release Latest company news, updates, and announcements.

Testimonials Real client stories sharing their success journeys.

7 Reasons to Invest Top benefits that make investing with us smart.

SEBI Registered Research Trusted insights backed by SEBI-compliant research.

Our Technology Advanced tools enabling efficient online trading.

Calculators Access a suite of smart tools to plan trades, margins, and returns effectively.

Margin Calculator Instantly check margin requirements for intraday and delivery trades.

MTF Calculator Calculate MTF funding cost upfront to ensure full transparency before placing a trade.

Brokerage Calculator Know your exact brokerage charges before placing any trade.

Market Place Explore curated investment products and trading tools in one convenient hub.

RMoney Gyan Enhance your market knowledge with expert blogs, videos, and tutorials.

Performance Tracker Track our research performance with full transparency using our performance tracker.

Feedback Share your suggestions or concerns to help us improve your experience.

Downloads Access important forms, software, and documents in one place.

Locate Us Find the nearest RMoney branch or service center quickly.

Escalation Matrix Resolve issues faster with our structured support escalation process.

Back Office Log in to view trade reports, ledger, and portfolio statements anytime.

Account Modification Update personal or bank details linked to your trading account.

Fund Transfer Transfer funds instantly online with quick limit updation to your trading account.

Bank Details View our registered bank account details for seamless transactions by NEFT, RTGS or IMPS.

How to Apply IPO Step-by-step guide to apply for IPOs using your trading account.

RMoney Quick Mobile App Trade on-the-go with our all-in-one mobile trading app.

RMoney Quick login Quickly access your trading account through the RMoney Quick web-based trading.

RMoney Rocket Web Version Experience powerful web-based trading with advanced tools for algo traders.

RMoney Rocket Mobile Version Trade anytime, anywhere with our feature-rich mobile trading platform.

Key Benefits of Gamma Scalping

Key Benefits of Gamma Scalping