Introduction

Delta neutrality, a core principle in options trading aims to create a portfolio immune to small price movements in the underlying asset. It is commonly used by institutional players, prop desks, and increasingly, advanced retail traders via algorithmic strategies.

But while the theory sounds elegant, maintaining delta neutrality in live markets is anything but simple. Constant monitoring, recalibration, market volatility, slippage, and cost structures often make this task practically complex and sometimes counterproductive.

In this blog, we’ll break down the concept of dynamic hedging, explore how delta-neutral portfolios are managed in real-time, and highlight the real-world challenges Indian traders must navigate.

Understanding Delta and Delta Neutrality

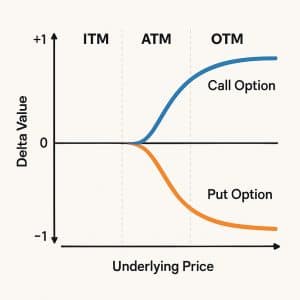

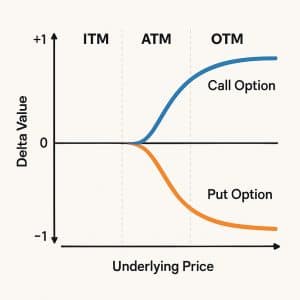

What is Delta?

Delta measures how much the price of an option is expected to move for a ₹1 change in the underlying. For instance:

- A call option with delta of +0.6 means the premium moves ₹0.60 for every ₹1 change in the underlying.

- A put option with delta of -0.4 implies a ₹0.40 fall in premium per ₹1 rise in the underlying.

Delta Neutral Strategy

A delta-neutral portfolio is constructed so that the total delta is approximately zero. This means the portfolio’s value remains stable for small movements in the underlying, offering hedging benefits.

Example:

If you sell one lot of Nifty call with delta +0.5 and buy one lot of Nifty put with delta -0.5, your net delta becomes zero (approximately), making it delta-neutral at initiation.

What is Dynamic Hedging?

Delta neutrality is not static. Since option deltas change with price movements, volatility, and time (a concept called “Gamma”), you need to adjust your position continuously to maintain neutrality. This is called Dynamic Hedging.

Traders rebalance by:

- Adding/removing positions

- Using futures or spot to offset delta

- Adjusting ratios as delta shifts

While this may work in controlled conditions or backtests, live market scenarios often introduce complexities.

Practical Challenges of Maintaining Delta Neutrality

1. Frequent Adjustments and High Transaction Costs

Every adjustment to maintain neutrality incurs brokerage, slippage, STT/CTT, and GST. In India’s T+1 and options-heavy environment, these costs quickly eat into returns.

Best Practice: Limit over-trading by using a tolerance range (e.g., rebalance only if delta shifts ±0.10 from neutral).

2. Gamma Risk and Whipsaws

Delta-neutral strategies are vulnerable to Gamma risk—the rate at which delta changes. In volatile or sideways markets, you’ll constantly chase neutrality due to false breakouts.

Example:

Nifty moves 150 points up in the morning (you adjust delta), then falls back 120 points (you adjust again), resulting in loss from constant rebalancing.

Solution: Use low gamma positions or wider break-even spreads (e.g., iron condors or box spreads) to reduce rebalancing.

3. Liquidity Constraints

Dynamic hedging requires fast execution in options and futures. Illiquid strikes or wide bid-ask spreads—especially in Bank Nifty weekly contracts or deep OTM options—can result in partial fills and poor execution.

Solution: Stick to liquid strikes (ATM and one or two OTM/ITM levels), especially when expiry is near.

4. Execution Speed and Slippage

Even a few seconds delay in execution can change delta significantly—especially in high beta stocks or during events like RBI policy or US Fed meetings.

Solution: Use algo platforms with dynamic hedge automation or execution tools like:

- Tradetron with delta formula triggers

- AlgoTest with rebalancing logic

- XTS API integrations

5. Impact of Event Volatility

Events like budget announcements, earnings, or geopolitical news can spike India VIX, causing wild delta swings and frequent adjustments. Hedging during such periods becomes both difficult and expensive.

Solution: Temporarily reduce position size or hedge with long options instead of trying to stay perfectly neutral.

4. Indian Market-Specific Considerations

- STT on Sell Side: You pay STT only on the sell leg of options—so hedging with long options (e.g., protective puts) can reduce exit friction.

- Lot Sizes & Margins: NSE’s lot sizes often restrict precise hedging. For example, Nifty lot is 50, so achieving fractional delta matching becomes difficult without excess capital.

- Weekly Expiries: Bank Nifty, Nifty, and Fin Nifty have weekly expiries—this increases the gamma and frequency of delta changes.

5. Smart Hedging Alternatives

Instead of obsessively staying delta-neutral, many traders adopt:

- Static Hedging: Fixed hedge ratio updated daily

- Volatility-Weighted Hedging: Adjust hedge size based on VIX readings

- Box Strategies: Offer delta-neutral payout with fixed returns

Note: These are advanced structures and need margin calculations, legwise execution, and exit planning. Retail traders can use platforms like XTS A3, stoxxo, Quantower or even your own trading bots which you can connect with RMoney’s fast and seamless APIs for your

Conclusion: Delta Neutrality is a Goal, Not a Constant

While delta-neutral strategies help manage directional risk, maintaining exact neutrality is rarely practical. In India’s dynamic options market, traders should aim for balance not perfection and adapt strategies based on cost, volatility, and execution ease.

Use RMoney’s free API to connect with platforms like Tradetron, Stoxxo, Quantower, , AlgoTest. Automate your delta adjustments, reduce manual effort, and stay efficiently hedged.

Disclaimer: This Blog is for educational purposes only and does not constitute investment advice. Always consult with a financial advisor before making trading decisions.

Stock Trading Now trade in ₹9 Per Order or ₹ 999 Per Month Plans.

Future & Options Access F&O contracts with advanced tools for hedging and speculation.

Currency Trading Trade in major currency pairs and manage forex exposure efficiently.

Commodity Trading Diversify Trading with MCX & NCDEX by Trading in Gold, Silver, Base Metals, Energy, and Agri Products.

Margin Trading Funding Boost your buying power with upto 5X, Buy now Pay Later

Algo Trading Back test, Paper Trade your logic & Automate your strategies with low-latency APIs.

Trading View Leverage Trading View charts and indicators integrated into your trading platform.

Advanced Options Trading Execute multi-leg option strategies with precision and insights.

Stock Lending & Borrowing Earn passive income by lending stocks securely through SLB.

Foreign Portfolio Investment Enable NRIs and FPIs to invest in Indian markets with ease and compliance.

IPO Invest in upcoming IPOs online with real-time tracking and instant allotment updates.

Direct Mutual Funds 0% Commissions by investing in more than +3500 Direct Mutual Fund Scheme.

Corporate FDRs Earn fixed returns with low-risk investments in high-rated corporate fixed deposits.

Stocks SIPs Build long-term wealth with systematic investment plans in top-performing stocks.

Bonds & NCDs Access secure, fixed-income investments through government and corporate bond offerings.

Depository Services Safely hold and manage your securities with seamless Demat and DP services with CDSL.

Journey Tracing our growth and milestones over time.

Mission & Vision Guided by purpose, driven by long-term vision.

Why RMoney Platform Smart, reliable platform for all investors' needs.

Management Experienced leadership driving strategic financial excellence.

Credentials Certified expertise with trusted industry recognition.

Press Release Latest company news, updates, and announcements.

Testimonials Real client stories sharing their success journeys.

7 Reasons to Invest Top benefits that make investing with us smart.

SEBI Registered Research Trusted insights backed by SEBI-compliant research.

Our Technology Advanced tools enabling efficient online trading.

Calculators Access a suite of smart tools to plan trades, margins, and returns effectively.

Margin Calculator Instantly check margin requirements for intraday and delivery trades.

MTF Calculator Calculate MTF funding cost upfront to ensure full transparency before placing a trade.

Brokerage Calculator Know your exact brokerage charges before placing any trade.

Market Place Explore curated investment products and trading tools in one convenient hub.

RMoney Gyan Enhance your market knowledge with expert blogs, videos, and tutorials.

Performance Tracker Track our research performance with full transparency using our performance tracker.

Feedback Share your suggestions or concerns to help us improve your experience.

Downloads Access important forms, software, and documents in one place.

Locate Us Find the nearest RMoney branch or service center quickly.

Escalation Matrix Resolve issues faster with our structured support escalation process.

Back Office Log in to view trade reports, ledger, and portfolio statements anytime.

Account Modification Update personal or bank details linked to your trading account.

Fund Transfer Transfer funds instantly online with quick limit updation to your trading account.

Bank Details View our registered bank account details for seamless transactions by NEFT, RTGS or IMPS.

How to Apply IPO Step-by-step guide to apply for IPOs using your trading account.

RMoney Quick Mobile App Trade on-the-go with our all-in-one mobile trading app.

RMoney Quick login Quickly access your trading account through the RMoney Quick web-based trading.

RMoney Rocket Web Version Experience powerful web-based trading with advanced tools for algo traders.

RMoney Rocket Mobile Version Trade anytime, anywhere with our feature-rich mobile trading platform.