Introduction

Algorithmic trading has revolutionized modern financial markets, offering traders the power of speed, precision, and scalability. Yet, despite its technological edge, many Algo strategies fail to deliver consistent results when deployed in real-world conditions. The gap between backtested brilliance and live market Performance often lies in overlooked details.

In this article, we’ll uncover some critical reasons why Algo trading strategies are complex than it actually seems—and more importantly, how you can build more reliable systems by avoiding these mistakes.

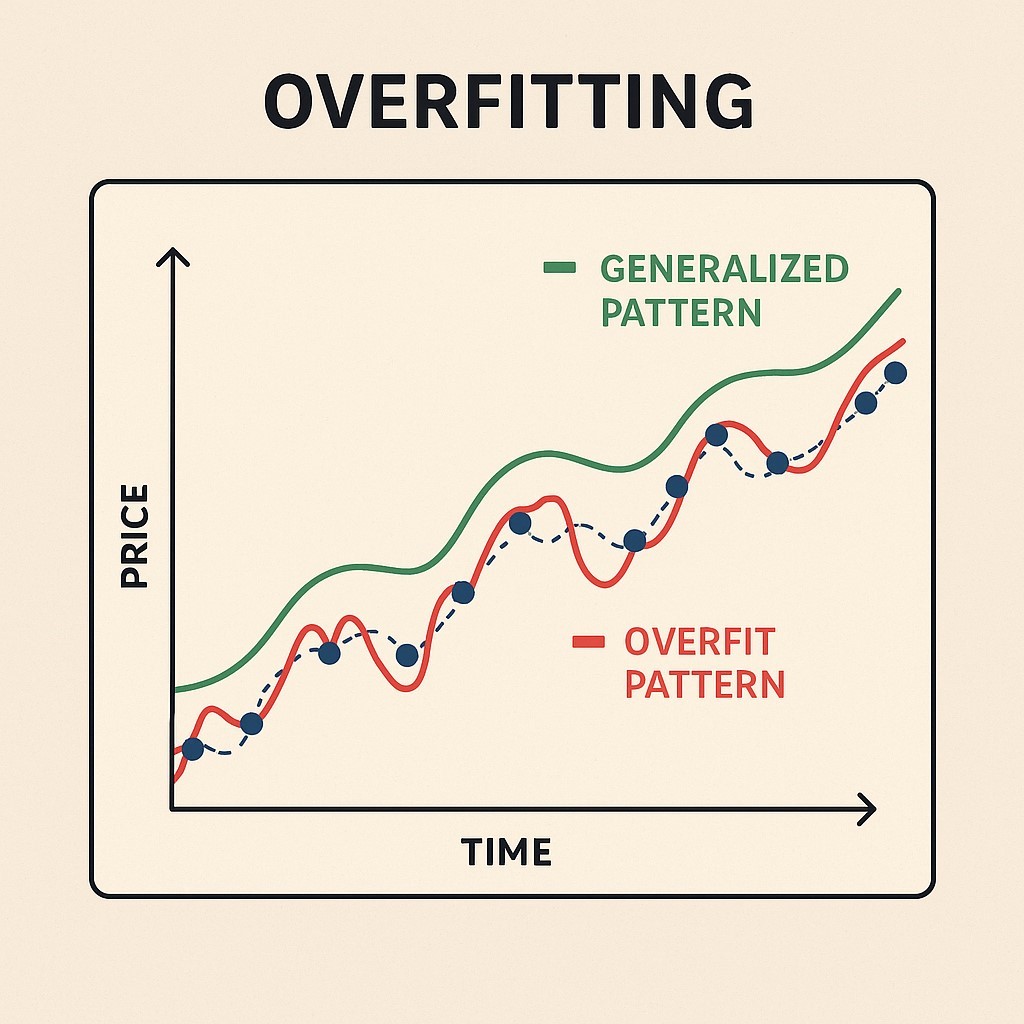

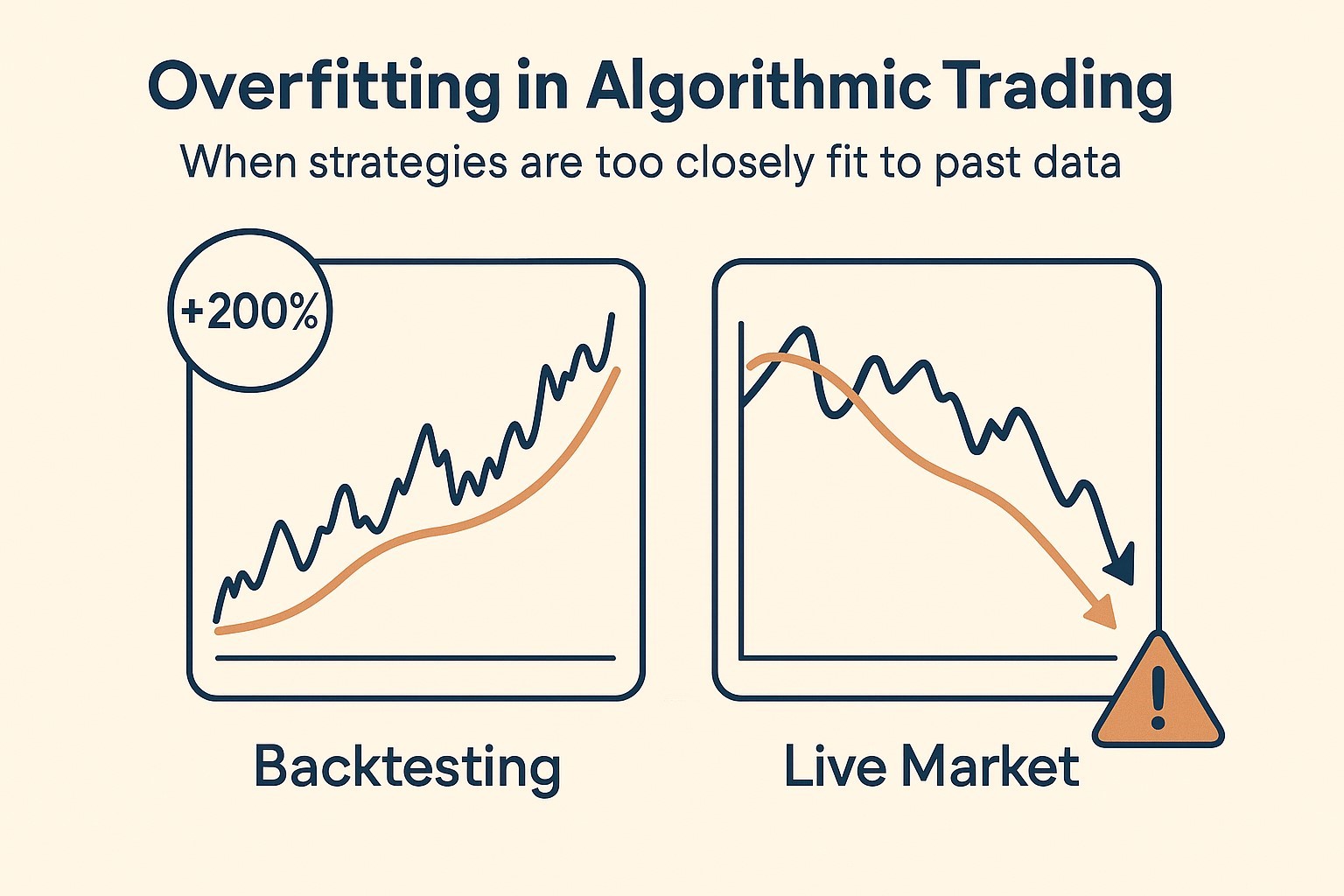

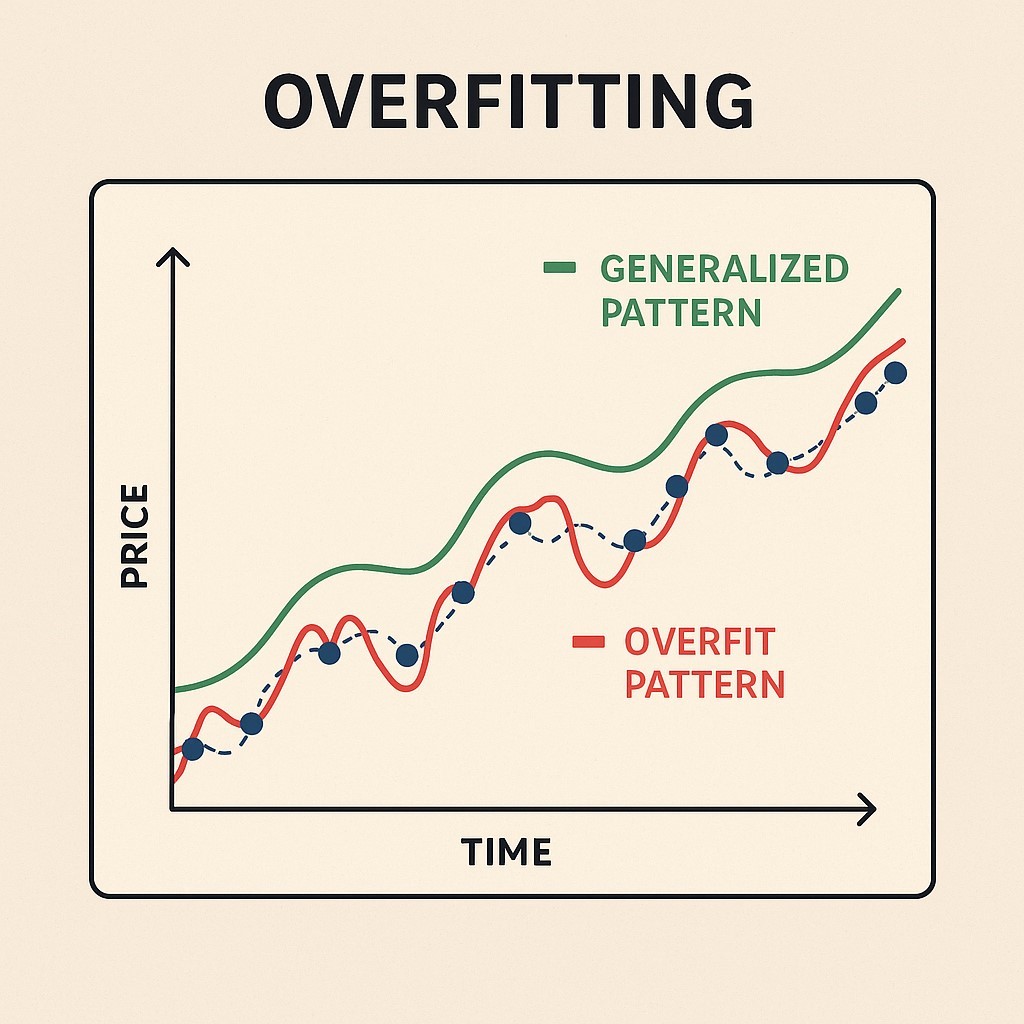

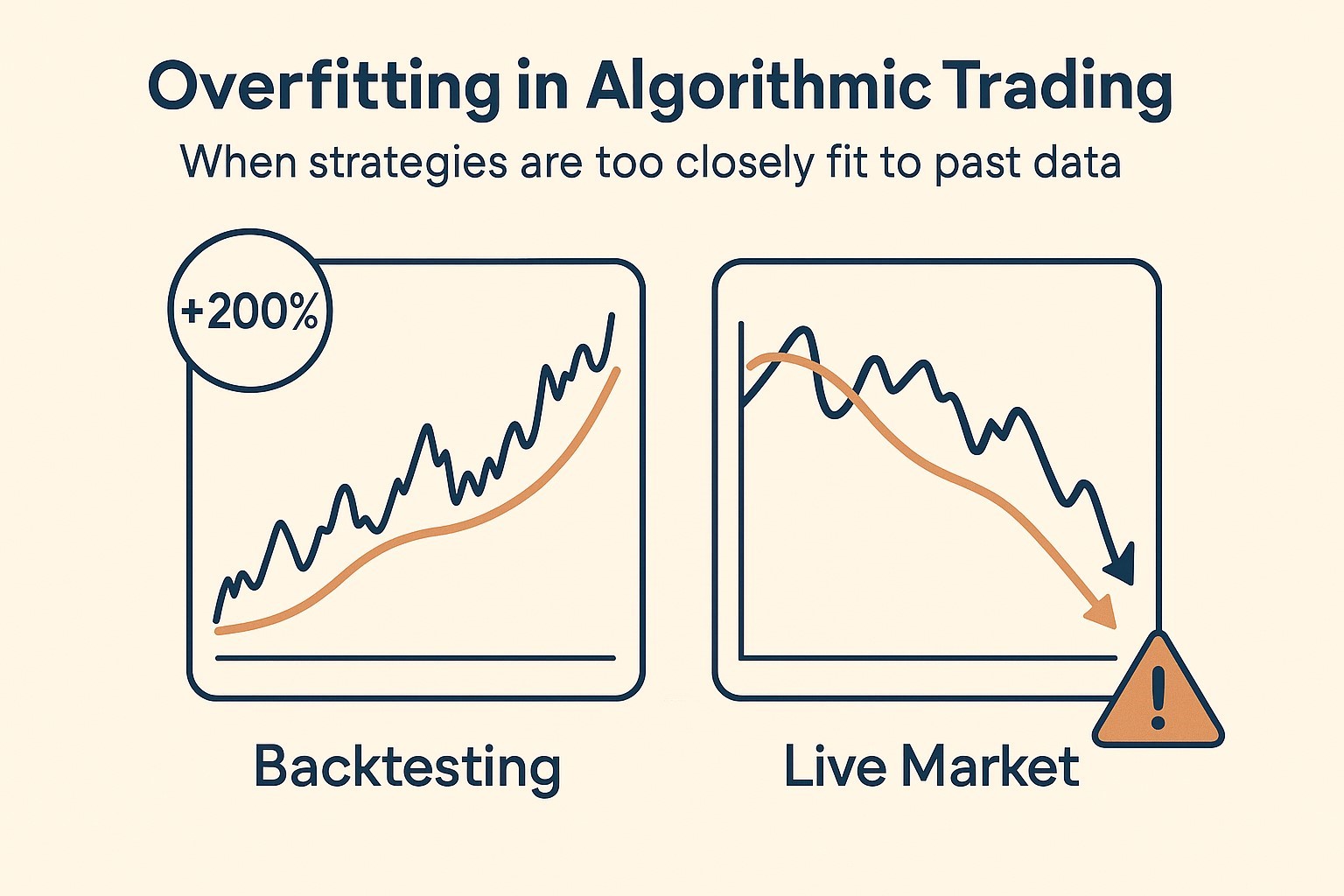

- Overfitting: When Past Data Misleads Future Trades

The Problem: Many traders design strategies that perform exceptionally well on historical data but collapse in live trading. This is known as overfitting—where the model is tailored too tightly to past patterns, capturing noise instead of signal.

Red Flags:

- Unrealistic backtest returns (e.g., 200% + annual gains)

- Strategies with more than 20 adjustable parameters

- Significant underperformance when tested on new market periods

What to Do Instead:

- Cross-Validate: Always test your strategy on out-of-sample data—reserve 30% of your historical dataset.

- Simplify Parameters: Limit yourself to 5–7 core variables.

- Test across Market Phases: Validate performance in bull, bear, and sideways markets.

A solid strategy should show dependable results across different indices like Nifty 50 and even global markets like the S&P 500.

2. Ignoring Transaction Costs: The Silent Profit Killer

The Problem:

Many traders get excited by strong backtested returns but overlook the real-world friction of trading—brokerage, slippage, taxes, and hidden charges. This blind spot quietly destroys strategy performance in live markets.

Real Example:

A trader running a high-frequency intraday system saw 12% profits in a paper-trading environment. But in live execution, the strategy posted a 5% loss due to cumulative impact of slippage and brokerage (₹0.10 per share slippage × 100+ trades/day = wiped-out gains).

Common Oversights:

- Ignoring brokerage costs in each trade leg

- Underestimating slippage during volatile or illiquid hours

- Executing large orders that move market prices (market impact)

- Forgetting statutory charges like STT/CTT, stamp duty, exchange fees, and GST

Execution Tip:

Even a ₹0.15 per share slippage across 500 shares daily adds up to ₹75/day, or nearly ₹1.5 lakh/year. That’s enough to flip a profitable strategy to a loss-maker.

What to Do Instead:

- Simulate Slippage in Backtests: Use realistic assumptions—₹0.05–₹0.15 for equities.

- Apply Volume Filters: Avoid placing orders that exceed 5% of a stock’s average daily volume to reduce market impact.

- Choose Smart Brokerage Plans: Use ultra-discount brokerage accounts when running high-turnover strategies.

- Calculate Break-Even Win Rate: Determine how many trades must succeed just to cover costs. This helps clarify your real risk-reward dynamics and sets more realistic expectations.

- Poor Risk Management: A Fast Track to Capital Loss

The Problem: Many Algo strategies focus heavily on entry signals while ignoring risk management factors like position sizing, stop losses, and asset diversification.

Case Study:

A trader risked 4% of capital on each trade using a leveraged Nifty futures strategy. Three losing trades wiped out 12% of their portfolio.

Common Oversights:

- Uniform position sizes regardless of market volatility

- Lack of stop-loss settings during volatile news events

- Heavy concentration in a single sector, like banking or IT

Risk Control Strategies:

- Volatility-Based Sizing: Use ATR (Average True Range) to dynamically size trades.

- Layered Stop Losses:

- Technical:5x ATR trailing stop

- Time-Based: Exit trades inactive after 72 hours

- Portfolio-Based: Cap daily drawdown at 8%

- Diversify Smartly: Spread capital across different asset classes—equity, commodities, debt—to reduce correlation risk.

4. Set and Forget? Think Again. Algorithms Need Maintenance

The Problem: Some traders believe that once an algorithm is live, it can run on autopilot forever. This assumption is risky—markets evolve, and so must your system.

Real Incident:

A gold arbitrage strategy failed for six months because it wasn’t updated after RBI revised import duties, altering the price dynamics.

Signs Your Algo Needs Review:

- Sharpe or Sortino ratios drop by over 30%

- A sudden shift in trading patterns (e.g., overnight trades from a day-only strategy)

- Changes in market rules (like T+1 settlements) affecting execution logic

Maintenance Checklist:

- Automated Alerts: Flag abnormal performance changes (e.g., >3% daily drawdown).

- Quarterly Tune-Ups: Recalibrate using the latest year’s data.

- Document Changes: Keep a log of all strategy modifications and their impact.

- Letting Emotions Override Automation

The Problem: Algo trading is meant to remove human emotion—but some traders still intervene during minor drawdowns, leading to missed opportunities and inconsistency.

Psychological Trap:

A trader deactivated the short-selling component of their system after a few failed trades—just before the market dropped 15%, a move the algo had correctly anticipated.

Common Mistakes:

- Manually skipping trades during losing streaks

- Constantly tweaking parameters after losses

- Increasing trade sizes impulsively to “recover” past losses

Fix the Process, Not the Trade:

- Strict Rule-Based Overrides: Only intervene during technical issues.

- Review Logs: If manual interventions happen more than twice a month, reduce discretion further.

- Trade in Isolation: Use separate devices or terminals to avoid emotional impulse during live trading hours.

Final Thoughts: Turning Failure into Strategy

Algorithmic trading isn’t just about clever code or complex math — it’s about discipline, constant learning, and proactive management. By avoiding these five common pitfalls, traders can build more resilient strategies that adapt to the real world—not just the backtest.

Smart Algo Trading Checklist:

- Test across multiple market conditions

- Include realistic slippage and brokerage in simulations

- Risk no more than 1–2% of capital per trade

- Run monthly reviews of strategy performance

- Keep detailed records of every system change

For more information, contact RMoney at 0562-4266600 / 0562-7188900 or email us at askus@rmoneyindia.com

Disclaimer:-Investments in the securities market are subject to market risks. This content is for Educational purposes only and does not constitute financial advice.

Stock Trading Now trade in ₹9 Per Order or ₹ 999 Per Month Plans.

Future & Options Access F&O contracts with advanced tools for hedging and speculation.

Currency Trading Trade in major currency pairs and manage forex exposure efficiently.

Commodity Trading Diversify Trading with MCX & NCDEX by Trading in Gold, Silver, Base Metals, Energy, and Agri Products.

Margin Trading Funding Boost your buying power with upto 5X, Buy now Pay Later

Algo Trading Back test, Paper Trade your logic & Automate your strategies with low-latency APIs.

Trading View Leverage Trading View charts and indicators integrated into your trading platform.

Advanced Options Trading Execute multi-leg option strategies with precision and insights.

Stock Lending & Borrowing Earn passive income by lending stocks securely through SLB.

Foreign Portfolio Investment Enable NRIs and FPIs to invest in Indian markets with ease and compliance.

IPO Invest in upcoming IPOs online with real-time tracking and instant allotment updates.

Direct Mutual Funds 0% Commissions by investing in more than +3500 Direct Mutual Fund Scheme.

Corporate FDRs Earn fixed returns with low-risk investments in high-rated corporate fixed deposits.

Stocks SIPs Build long-term wealth with systematic investment plans in top-performing stocks.

Bonds & NCDs Access secure, fixed-income investments through government and corporate bond offerings.

Depository Services Safely hold and manage your securities with seamless Demat and DP services with CDSL.

Journey Tracing our growth and milestones over time.

Mission & Vision Guided by purpose, driven by long-term vision.

Why RMoney Platform Smart, reliable platform for all investors' needs.

Management Experienced leadership driving strategic financial excellence.

Credentials Certified expertise with trusted industry recognition.

Press Release Latest company news, updates, and announcements.

Testimonials Real client stories sharing their success journeys.

7 Reasons to Invest Top benefits that make investing with us smart.

SEBI Registered Research Trusted insights backed by SEBI-compliant research.

Our Technology Advanced tools enabling efficient online trading.

Calculators Access a suite of smart tools to plan trades, margins, and returns effectively.

Margin Calculator Instantly check margin requirements for intraday and delivery trades.

MTF Calculator Calculate MTF funding cost upfront to ensure full transparency before placing a trade.

Brokerage Calculator Know your exact brokerage charges before placing any trade.

Market Place Explore curated investment products and trading tools in one convenient hub.

RMoney Gyan Enhance your market knowledge with expert blogs, videos, and tutorials.

Performance Tracker Track our research performance with full transparency using our performance tracker.

Feedback Share your suggestions or concerns to help us improve your experience.

Downloads Access important forms, software, and documents in one place.

Locate Us Find the nearest RMoney branch or service center quickly.

Escalation Matrix Resolve issues faster with our structured support escalation process.

Back Office Log in to view trade reports, ledger, and portfolio statements anytime.

Account Modification Update personal or bank details linked to your trading account.

Fund Transfer Transfer funds instantly online with quick limit updation to your trading account.

Bank Details View our registered bank account details for seamless transactions by NEFT, RTGS or IMPS.

How to Apply IPO Step-by-step guide to apply for IPOs using your trading account.

RMoney Quick Mobile App Trade on-the-go with our all-in-one mobile trading app.

RMoney Quick login Quickly access your trading account through the RMoney Quick web-based trading.

RMoney Rocket Web Version Experience powerful web-based trading with advanced tools for algo traders.

RMoney Rocket Mobile Version Trade anytime, anywhere with our feature-rich mobile trading platform.