Introduction

In the world of financial markets, timing is often the difference between profit and missed opportunity. Among the many strategies traders use, breakout trading stands out for its ability to catch strong price movements at their inception. Whether you trade stocks, indices, commodities, or currencies, mastering the breakout strategy can give you a significant edge. However, as with any trading approach, success depends on understanding the mechanics, filtering out false signals, and employing robust risk management. In this guide, we’ll explore what breakout trading is, the psychology behind it, the different types of breakouts, and the essential tools and techniques to help you trade breakouts like a seasoned professional.

What is a Breakout in Trading?

A breakout occurs when the price of a security moves decisively outside a well-established support or resistance level, often accompanied by a noticeable increase in trading volume. This movement signals that the market is transitioning from a period of consolidation (where price moves sideways) to a new trend direction. Traders interpret breakouts as opportunities to enter trades early in the trend, aiming to ride the momentum for significant gains. The key is to distinguish between genuine breakouts and false ones, which can trap unsuspecting traders.

The Psychology behind Breakouts

Market psychology plays a crucial role in breakout trading. During consolidation phases, buyers and sellers are in a temporary equilibrium, resulting in sideways price action. Support and resistance levels form as the market tests these boundaries repeatedly. When price finally breaks through a key level—especially one that has been tested multiple times—it signals a shift in the balance of power. Either buyers (bulls) or sellers (bears) have gained control, or this shift often triggers a surge in trading activity as traders rush to capitalize on the new trend. Understanding this psychological dynamic is essential for anticipating and confirming breakout opportunities.

Types of Breakouts Every Trader Should Know

Not all breakouts are created equal. Recognizing the structure behind different breakout types can help you assess their reliability and trade them effectively:

- Horizontal (Range) Breakout

This occurs when price moves beyond a well-defined horizontal support or resistance level after a period of sideways movement.

Example: A stock trades between ₹100 and ₹110 for several weeks. A breakout above ₹110 on strong volume signals a potential long trade.

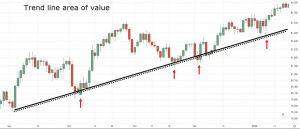

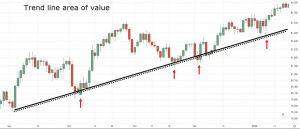

- Trendline Breakout

A trendline breakout happens when price breaks above a downward-sloping trendline (indicating a possible bullish reversal) or below an upward-sloping trendline (indicating a bearish reversal).

Use case: After a series of lower highs, price breaks above a descending trendline, signaling a shift in momentum.

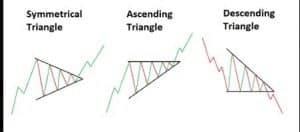

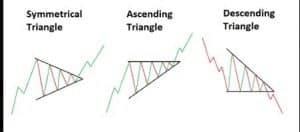

- Triangle Breakout

Triangles (symmetrical, ascending, or descending) represent a narrowing of price action. A breakout from the triangle’s boundaries often leads to sharp, directional moves.

Tip: Watch for breakouts near the triangle’s apex and confirm with volume.

- Flag and Pennant Breakout

these are continuation patterns that form after a sharp price move. A brief consolidation creates a flag or pennant shape, and a breakout signals a resumption of the prior trend.

Useful in: Fast-moving markets where momentum resumes after consolidation.

- Head and Shoulders Breakout

this classic reversal pattern consists of three peaks (the head and two shoulders). A break below the neckline (for a head and shoulders top) or above (for an inverse head and shoulders) often triggers a new trend direction.

Breakout Trading Example: From Setup to Profit

Let’s consider a practical scenario. Imagine stock ABC rallies from ₹50 to ₹100, then consolidates between ₹100 and ₹110 for several weeks. A trader identifies the resistance at ₹110 and watches for a breakout. One day, the price surges above ₹110 on increased volume. The trader enters a long position, places a stop-loss just below the breakout level (e.g., ₹108), and sets a target based on the prior move—say, ₹150. Over the next few sessions, the stock hits ₹150, resulting in a successful breakout trade. This example highlights the importance of patience, confirmation, and disciplined risk management.

How to Confirm a Genuine Breakout

Spotting breakouts is straightforward; trading them profitably is more challenging. Many breakouts fail, leading to losses for traders who jump in too early. Here’s how to confirm a breakout’s validity:

- Volume Spike:

Genuine breakouts are usually accompanied by higher-than-average trading volume, indicating institutional participation and conviction.

- Retest of Breakout Level:

After the breakout, price may pull back to test the broken level. If it holds as new support or resistance, the breakout is likely valid.

- Momentum Indicators:

Technical indicators like RSI (crossing above 60) or a rising MACD histogram can provide additional confirmation of breakout strength.

- Market Sentiment:

Look for catalysts such as earnings announcements, macroeconomic news, or sector-wide momentum that can validate the breakout.

Common Pitfalls in Breakout Trading

Breakout trading is not without risks. Here are some common pitfalls and how to avoid them:

- Failed Breakouts (Fakeouts):

Sometimes, price briefly moves beyond a level only to reverse and trap traders.

Solution: Wait for a confirmation candle or a successful retest before entering the trade.

- Emotional Decisions:

Traders often enter trades impulsively, especially after watching a stock hover near a resistance for days.

Solution: Stick to a clear, rule-based entry system and avoid chasing price.

- Ignoring Market Conditions:

In volatile or illiquid markets, breakouts are more likely to fail due to erratic price swings.

Solution: Avoid trading breakouts during low liquidity periods or major news events unless they align with your setup.

Key Tools for Breakout Traders

Successful breakout traders rely on a combination of technical tools and indicators:

- Support & Resistance Drawing Tools:

Identify key levels where breakouts are likely to occur.

- Volume Profile or On-Balance Volume (OBV):

Analyze volume trends to confirm breakout strength.

- Moving Averages (e.g., 20 EMA, 50 EMA):

Use moving averages to identify trend direction and dynamic support/resistance.

- RSI and MACD:

Gauge momentum and trend strength.

- Trendlines and Chart Patterns:

Recognize breakout setups and potential reversal points.

Risk Management Tips for Breakout Trading

Managing risk is paramount in breakout trading. Here’s how to protect your capital:

- Use Stop-Loss Orders:

Place stop-loss orders just below breakout levels to limit potential losses.

- Limit Risk Per Trade:

Risk only 1–2% of your trading capital on any single trade.

- Avoid Overtrading:

Not every breakout is worth trading. Focus on quality setups.

- Position Sizing:

Adjust your position size based on the asset’s volatility (consider using the Average True Range, ATR).

- Diversification:

Avoid taking multiple breakout trades in highly correlated assets or sectors simultaneously.

Why Breakout Trading Appeals to Traders

Breakout trading offers several advantages:

- High Reward-to-Risk Ratios:

Early entries in new trends can yield risk-reward setups of 1:3 or better.

- Momentum Participation:

Institutions and large players often drive momentum after breakouts, increasing the potential for sustained moves.

- Versatility:

Breakout principles apply across asset classes—equities, commodities, currencies, and indices.

Conclusion

Breakout trading is a powerful strategy for capturing significant market moves, but it requires discipline, patience, and a solid understanding of market dynamics. Simply spotting a breakout isn’t enough—waiting for confirmation, managing your risk, and understanding the broader market context are what separate successful breakout traders from those who get caught in false moves. By equipping yourself with the right tools, following a clear plan, and maintaining objectivity, you can make breakout trading a valuable part of your trading arsenal.

Need Help?

Contact RMoney at 0562-4266600 / 0562-7188900 or email

askus@rmoneyindia.com

Disclaimer: This Blog is intended for educational purposes only. Securities/investments mentioned here are not investment advice or recommendations.

Stock Trading Now trade in ₹9 Per Order or ₹ 999 Per Month Plans.

Future & Options Access F&O contracts with advanced tools for hedging and speculation.

Currency Trading Trade in major currency pairs and manage forex exposure efficiently.

Commodity Trading Diversify Trading with MCX & NCDEX by Trading in Gold, Silver, Base Metals, Energy, and Agri Products.

Margin Trading Funding Boost your buying power with upto 5X, Buy now Pay Later

Algo Trading Back test, Paper Trade your logic & Automate your strategies with low-latency APIs.

Trading View Leverage Trading View charts and indicators integrated into your trading platform.

Advanced Options Trading Execute multi-leg option strategies with precision and insights.

Stock Lending & Borrowing Earn passive income by lending stocks securely through SLB.

Foreign Portfolio Investment Enable NRIs and FPIs to invest in Indian markets with ease and compliance.

IPO Invest in upcoming IPOs online with real-time tracking and instant allotment updates.

Direct Mutual Funds 0% Commissions by investing in more than +3500 Direct Mutual Fund Scheme.

Corporate FDRs Earn fixed returns with low-risk investments in high-rated corporate fixed deposits.

Stocks SIPs Build long-term wealth with systematic investment plans in top-performing stocks.

Bonds & NCDs Access secure, fixed-income investments through government and corporate bond offerings.

Depository Services Safely hold and manage your securities with seamless Demat and DP services with CDSL.

Journey Tracing our growth and milestones over time.

Mission & Vision Guided by purpose, driven by long-term vision.

Why RMoney Platform Smart, reliable platform for all investors' needs.

Management Experienced leadership driving strategic financial excellence.

Credentials Certified expertise with trusted industry recognition.

Press Release Latest company news, updates, and announcements.

Testimonials Real client stories sharing their success journeys.

7 Reasons to Invest Top benefits that make investing with us smart.

SEBI Registered Research Trusted insights backed by SEBI-compliant research.

Our Technology Advanced tools enabling efficient online trading.

Calculators Access a suite of smart tools to plan trades, margins, and returns effectively.

Margin Calculator Instantly check margin requirements for intraday and delivery trades.

MTF Calculator Calculate MTF funding cost upfront to ensure full transparency before placing a trade.

Brokerage Calculator Know your exact brokerage charges before placing any trade.

Market Place Explore curated investment products and trading tools in one convenient hub.

RMoney Gyan Enhance your market knowledge with expert blogs, videos, and tutorials.

Performance Tracker Track our research performance with full transparency using our performance tracker.

Feedback Share your suggestions or concerns to help us improve your experience.

Downloads Access important forms, software, and documents in one place.

Locate Us Find the nearest RMoney branch or service center quickly.

Escalation Matrix Resolve issues faster with our structured support escalation process.

Back Office Log in to view trade reports, ledger, and portfolio statements anytime.

Account Modification Update personal or bank details linked to your trading account.

Fund Transfer Transfer funds instantly online with quick limit updation to your trading account.

Bank Details View our registered bank account details for seamless transactions by NEFT, RTGS or IMPS.

How to Apply IPO Step-by-step guide to apply for IPOs using your trading account.

RMoney Quick Mobile App Trade on-the-go with our all-in-one mobile trading app.

RMoney Quick login Quickly access your trading account through the RMoney Quick web-based trading.

RMoney Rocket Web Version Experience powerful web-based trading with advanced tools for algo traders.

RMoney Rocket Mobile Version Trade anytime, anywhere with our feature-rich mobile trading platform.